A2ii Newsflash | Inclusive insurance developments in Latin America: Bolivia and Paraguay launch regulatory frameworks

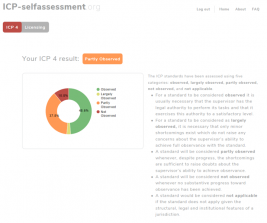

We invite you to browse our Inclusive Insurance Regulations Map for more information, where you can filter by region and type of intervention (such as dedicated licencing, gendered aspects, and index insurance).

Do you have any regulatory updates to share? Please email secretariat@a2ii.org.

Versión en español a continuación

Bolivia

Recently, the Autoridad de Supervisión y Control de Pensiones y Seguros (Pensions and Insurance Supervision Authority - APS) of Bolivia launched an inclusive insurance regulatory framework through resolución administrativa 1132-2022. The regulation is a direct result of the action plan drawn up by the participants from APS during the Inclusive Insurance Training in 2019, which was subsequently supported by A2ii and the Toronto Centre.

‘Inclusive insurance is a financial instrument designed to protect sectors of society that are often excluded or not well served by traditional products created by the insurance market’.

Statement by Ivette Espinoza, Vice Minister of Pensions and Financial Services

Inclusive insurance is defined as products aimed at vulnerable segments of the population with limited access to traditional insurance (regardless of their level of income). The products are expected to protect against adverse situations and help affected families avoid falling deeper into poverty. Products must be designed to cover the identified needs of the target segment of the population.

The regulation states that:

- The contractual terms must be easy to understand for all parties. Any type of informative or advertising material must be simple, clear, and not misleading.

- Insurability requirements must be minimal, and the aim is that exclusions should be practically inexistent – if there are any, they should be accordance with the nature of the insurance to be underwritten and without infringing on the rights of the insured.

- Easy access to products should be guaranteed through points of sale, the internet or other electronic and digital means.

- Entities that issue inclusive insurance products must not require deductibles, waiting periods, and the coverage must start as soon as the premium has been paid. The resolution of claims must take place within a faster time frame than established in the Commercial Code. Intermediaries may be used, but their commissions must not have a significant impact on the amount of the premiums.

- Digital and electronic signatures and electronic means of transmitting information are enabled. Other minimum requirements are established for information security, and data reporting to APS.

‘The regulation is considered a major contribution to the development and strengthening of the Bolivian economy and a measure that contributes to the government’s financial inclusion policies’, said Regina Simões, A2ii Regional Coordinator for Latin America, who worked closely with the APS team.

Paraguay

Resolution No. 254/2022 was approved by the Central Bank of Paraguay, setting out the regulatory framework for microinsurance. Microinsurance is defined as products targeting the low-income population, providing for simple conditions and limited coverage for a reduced premium. The monthly premium for insured risk must not exceed one minimum daily wage.

Additionally, the Resolution states that:

- Insurance companies must design simplified mechanisms for premium collection.

- Microinsurance policies must be written in clear, precise and simple language. Contracts may be issued digitally and using electronic or digital signatures are allowed. There is a maximum of ten calendar days to issue the policy or reject an application.

- Claims payments must be issued in a ‘fast and efficient way’ and insurers may not make unreasonable demands for information or documents. Expenses (such as commission and product promotion) may not exceed 30% of the rate premium.

- Insurance entities must submit monthly statistical information on their microinsurance operations.

There is a general recognition that better access to insurance services helps to reduce poverty, improve social and economic development and meet the main objectives of public policies, such as improving the living conditions of the population, dealing with the effects of climate change and food security.

Resolution No. 254/2022

Elsewhere in the region, Brazil, Colombia and Costa Rica over the last two years have issued regulations and circular letters on microinsurance frameworks. Please see our inclusive insurance regulations map to explore more detailed information by country or type of intervention.

Newsflash | Desarrollos de seguros inclusivos en América Latina: nuevas regulaciones en Bolivia y Paraguay

Bolivia

Recientemente, la Autoridad de Supervisión y Control de Pensiones y Seguros (APS) de Bolivia lanzó un marco regulatorio de seguros inclusivos a través de la resolución administrativa 1132-2022. La normativa es un resultado directo del plan de acción elaborado por los participantes de la APS durante la Capacitación en Seguros Inclusivos de 2019, que posteriormente contó con el apoyo de A2ii y el Toronto Centre.

Los seguros inclusivos son instrumentos financieros destinados a proteger a sectores de la sociedad que muchas veces están excluidos o no están bien atendidos por los productos tradicionales creados por el mercado asegurador.

Ivette Espinoza, Viceministra de Pensiones y Servicios Financieros

En la resolución, los seguros inclusivos se definen como productos dirigidos a segmentos vulnerables de la población con acceso limitado a los seguros tradicionales (independientemente de su nivel de ingresos). Se espera que los productos protejan contra situaciones adversas y ayuden a las familias a evitar una mayor pobreza. Se deben diseñar los productos para cubrir las necesidades identificadas del segmento de la población al que van dirigidos.

El reglamento establece que:

- Las condiciones contractuales deben ser fáciles de entender para todas las partes. Cualquier tipo de material informativo o publicitario debe ser sencillo, claro y no engañoso.

- Los requisitos de asegurabilidad deben ser mínimos, y el objetivo es que las exclusiones sean prácticamente inexistentes -si las hay, deben ser acordes con la naturaleza del seguro a suscribir y sin vulnerar los derechos del asegurado.

- Debe garantizarse el fácil acceso a los productos a través de los puntos de venta, Internet u otros medios electrónicos y digitales.

- las entidades que emiten productos de seguros inclusivos no deben exigir franquicias, ni períodos de carencia, y la cobertura debe comenzar tan pronto como se haya pagado la prima. La resolución de los siniestros debe producirse en un plazo más corto que el establecido en el Código de Comercio. Se pueden utilizar intermediarios, pero sus comisiones no deben tener un impacto significativo en el importe de las primas.

- Quedan habilitados la firma digital y electrónica y los medios electrónicos de transmisión de información. Se establecen otros requisitos mínimos para la seguridad de la información, y la comunicación de datos a la APS.

"La normativa se considera una importante contribución al desarrollo y fortalecimiento de la economía boliviana y una medida que contribuye a las políticas de inclusión financiera del gobierno," dijo Regina Simões, Coordinadora Regional de A2ii para América Latina, que trabajó de cerca con el equipo de APS.

Paraguay

El Banco Central de Paraguay aprobó la Resolución Nº 254/2022, que establece el marco regulatorio de los microseguros. Los microseguros se definen como productos dirigidos a la población de bajos ingresos, que prevén condiciones simples y una cobertura limitada por una prima reducida. La prima mensual por riesgo asegurado no debe superar un salario mínimo diario.

Además, la Resolución establece que:

- Las compañías de seguros deben diseñar mecanismos simplificados para el cobro de las primas.

- Las pólizas de microseguros deben estar redactadas en un lenguaje claro, preciso y sencillo. Los contratos pueden ser emitidos digitalmente y se permite el uso de firmas electrónicas o digitales. Hay un máximo de diez días naturales para emitir la póliza o rechazar una solicitud.

- Los pagos de los siniestros deben emitirse de "forma rápida y eficaz" y las aseguradoras no pueden exigir información o documentos de forma poco razonable. Los gastos (como comisiones y promoción de productos) no pueden superar el 30% de la prima de tarifa.

- Las entidades aseguradoras deben presentar información estadística sobre sus operaciones de microseguros mensualmente.

Existe un reconocimiento general de que un mejor acceso a los servicios de seguros ayuda a reducir la pobreza, mejorar el desarrollo social y económico y cumplir los principales objetivos de las políticas públicas, como mejorar las condiciones de vida de la población, lidiar con los efectos del cambio climático y la seguridad alimentaria. La regulación y supervisión adecuadas pueden apoyar al acceso a los servicios de seguros, ya que evitarán barreras innecesarias para la oferta de servicios del mercado asegurador.

Resolución Nº 254/2022

En otros países de la región, Brasil, Colombia y Costa Rica, han emitido en los dos últimos años marcos regulatorios y circulares sobre microseguros. Consulte nuestro mapa de regulaciones de seguros inclusivos para explorar información más detallada por país o tipo de intervención.