A2ii Newsletter April-May 2024

Welcome! In this newsletter, we provide you with updates on the work of the A2ii, events and publications, and experiences and learning on inclusive insurance regulation and supervision across jurisdictions over the past month.

Follow us on Twitter @a2ii_org and LinkedIn and join the conversation on #inclusiveinsurance!

Subscribe to our mailing list to receive our newsletter in your inbox.

Navigation

News | Upcoming Events | iii-Lab Update | Recent Events | Blog | Partner Opportunity | FeMa Meter | Index Insurance | ICP Tool | Trainings | Useful Tools on Our Website

News

A2ii supports the General Superintendency of Insurance of Costa Rica (SUGESE) as part of the Global Shield against Climate Risks

The need for robust financial protection against the adverse impacts of climate change has never been more urgent. Recognising this imperative, the Access to Insurance Initiative (A2ii) and the International Association of Insurance Supervisors (IAIS) are supporting the Superintendencia General de Seguros de Costa Rica (SUGESE) to foster inclusive insurance markets. These efforts will also feed into Costa Rica's broader work on scaling up financial protection with the Global Shield against Climate Risks (GS).

Scholarship Opportunity

The A2ii is offering one full scholarship for an insurance supervisor for the ILO's Impact Insurance Academy, which will take place from September 30 to October 4, 2024 in Turin, Italy. The scholarship will cover the tuition, accommodation and meal costs and will be awarded through a competitive application process. Find out more here.

Upcoming events

A2ii-IAIS Public Dialogue: Launch of the Report on Sustainability and ESG Regulatory Landscape in the CEET region | 27 June

We are pleased to extend an invitation to the A2ii-IAIS Public Dialogue launch of the Report on Sustainability and ESG Regulatory Landscape in the CEET region.

It will take place on Thursday 27 June at 13:00 CEST (click here to view your time zone).

The insurance industry plays a vital role in mitigating and pooling risks, with core principles deeply intertwined with environmental, social, and governance (ESG) standards. As demands from investors, end customers, policymakers, and standard setters continue to rise, the explicit incorporation of ESG factors into insurance operations becomes increasingly essential.

To delve deeper into how ESG standards are integrating into the insurance sector across Central, Eastern Europe, and Transcaucasia (CEET), the Access to Insurance Initiative (A2ii), in collaboration with the Insurance Supervisory Agency of Slovenia (AZN), conducted a survey in 2023 aimed to evaluate the current state of insurance regulations and initiatives encouraging sustainable insurance growth in the CEET region.

Join us as we discuss the findings from this survey, which shed light on the progress and challenges of integrating ESG considerations into the CEET region's insurance sector.

Click here to register for the event.

The Dialogue will be held in English, with interpretation into French and Spanish. If you wish to submit questions in advance, please include them in the registration form or contact secretariat@a2ii.org.

iii-Lab 4 Update

The international cohort of the fourth A2ii Inclusive Insurance Innovation Lab (iii-lab) has successfully concluded the discovery phase, the first of three phases in the lab process.

Building on the momentum generated by national workshops held in February, each of the country teams from Armenia, Nepal, and Senegal engaged in extensive interviews with their target groups in the agricultural sector, mostly farmers and fishers, in order to identify the main challenges these groups are facing in the light of climate change.

These interviews were the basis for discussions during the international calls. Each country presented a creative Pecha-Kucha presentation, not only providing some insight on their rich cultural heritage but also diving into the state of insurance and climate risk within their respective jurisdictions. As they presented their findings, similarities and unique nuances among stakeholder perspectives emerged.

The interviews underscored a pervasive lack of trust in and understanding of insurance benefits among agricultural communities. Furthermore, there was an awareness of the immediate impacts of climate change on livelihoods across all regions, as encapsulated by an interviewee from Nepal: “As per my estimation, climate change has decreased my production by roughly 20%”.

However, distinct differences also surfaced: Senegal emphasised the importance of in-person distribution channels, while Nepal identified significant potential in digital distribution platforms. Armenia highlighted opportunities in leveraging smart farming appliances for data collection and greater resilience.

The interviews catalysed a shift in perceptions and prompted new inquiries, such as:

how to ensure the livelihoods of rural populations beyond traditional farming or fishing occupations,

how to deliver innovation effectively, and

how to address the specific needs of vulnerable groups.

As teams transition into the innovation phase, each country team will leverage the insights gained from this collaborative exchange to propel their respective initiatives forward. The stage is set for further collaboration and refinement as teams will convene in-person at the end of July.

The 4th iii-lab is a 12-month journey where teams from Armenia, Nepal and Senegal, consisting of key stakeholders from the insurance sector, are collaborating on innovative insurance solutions to increase resilience against the impact of climate change. For more information on the iii-lab, click here.

Recent events

Sub-Saharan Africa Regional Seminar | 27-31 May

The Sub-Saharan Africa Regional Seminar, themed "Addressing the Gaps for a Sustainable, Inclusive, and Resilient Insurance Industry," was organised by the Namibian Financial Institutions Supervisory Authority (NAMFISA) in partnership with the International Association of Insurance Supervisors (IAIS), the Financial Stability Institute (FSI), and the Access to Insurance Initiative (A2ii). Taking place from 27 to 31 May in Windhoek, Namibia, the event served as a forum for supervisors, industry experts, and policymakers to share regional insights and experiences on a variety of topics, such as protection gaps, climate resilience, financial inclusion, digital innovation, capacity building, and market conduct.

The seminar was divided into two main segments: the first three days were dedicated to closed-door sessions exclusively for supervisors, focusing on in-depth discussions and regional supervisory priorities. The final two days were open to industry participants and other relevant stakeholders, promoting broader participation and engagement. Participants engaged through various formats, including panel discussions, interactive workshops, and case studies. Over 60 supervisors and 40 stakeholders attended, contributing to a lively and comprehensive dialogue.

The A2ii was honoured to contribute to eight sessions. The A2ii's contributions included a presentation on inclusive insurance, leading a roundtable discussion on "Inclusive Insurance: Effective Regulatory Measures to Cultivate a Supportive Environment for Inclusive Insurance," and facilitating a plenary session on "Climate Change: Supervision of Climate-Related Risks in the Insurance Sector - the Learning Journey." Additionally, A2ii conducted sessions on capacity building, covering topics such as the FeMa-Meter, the Insurance Core Principles Self-Assessment Tool (ICP SAT), and leveraging actuarial skills. Lastly, A2ii participated in a panel discussion on "Closing the Supervisory Gaps to Expand Access to Affordable Insurance Products."

A2ii-IAIS Public Dialogue | 30 April

During this Public Dialogue, attendees heard insights about the recently published paper "Assessing the impact of inclusive insurance regulation in Brazil". The event started with an introduction from Luciana Dall'Agnol, Superintendent of Consumer Relations and Sustainibility at CNSeg (National Confederation of Insurers of Brazil), and Jessica Bastos, Director at SUSEP. Following the introduction, Hui Lin Chiew, A2ii, explained the methodology behind the impact assessment, and Regina Simoes, A2ii Regional Coordinator for Latin America and author of the paper, shared insights and results from the regulatory impact assessment, including the challenges that were faced. This study can provide a framework for supervisors wanting to assess the impact of their regulatory frameworks in the future.

The recording, both in English and Spanish, of the A2ii-IAIS Public Dialogue launch event of the paper Assessing the impact of inclusive insurance regulations in Brazil is available on our website.

The paper

Download the paper here. In 2021–2022, A2ii conducted an impact assessment in Brazil. The regulator introduced three significant sets of regulations on microinsurance and other inclusive insurance lines, the first being a dedicated microinsurance regulatory framework in 2011-2012. Subsequently, two further sets of regulations seeking to broaden insurance distribution and facilitate take-up were also issued.

This study aims to:

1. Share insights from regulatory impact assessment conducted in Brazil, including its challenges, and

2. Provide a framework for supervisors wanting to assess the impact of their regulatory frameworks in the future.

The XXII Conference on Insurance Regulation and Supervision in Latin America | 8-9 May, Montevideo, Uruguay

The XXII Conference on Insurance Regulation and Supervision in Latin America ASSAL-IAIS took place in Montevideo, Uruguay, on 8-9 May 2024. It was jointly organised by the Latin American Association of Insurance Supervisors (ASSAL), the International Association of Insurance Supervisors (IAIS), and the Central Bank of Uruguay (BCU).

Juan Pedro Cantera, Superintendent of Financial Services at BCU, Tomás Soley, President of ASSAL and General Superintendent of Insurance at SUSEGE, and Conor Donaldson, Head of Implementation of the IAIS, opened the conference.

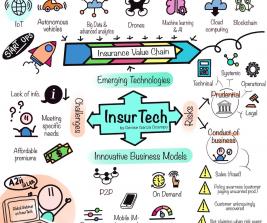

The agenda of the conference included a range of panels on trending topics such as Risk Based Capital, Insurtech, Climate Risks associated with Climate Change and Catastrophic Risks, Sustainable Development and the Role of Insurance, and Policyholder protection. The supervisors also presented the recent changes in Ibero-American regulations and legislations.

A2ii organised a session on "Insurance market development: inclusive insurance or microinsurance”, moderated by the A2ii Regional Coordinator Regina Simões, where the new A2ii Executive Director Matthias Range presented about the inclusive insurance case. Also on the panel were Maria Elisa Alonso, Head of the Technical and Annuities Division at the Financial Market Commission (CMF), who presented on the new index insurance regulation of Chile, and Alejandro Veiroj, Executive Director of the Uruguayan Association of Insurance Companies (AUDEA), presenting about the industry’s initiative to promote access to life insurance in Uruguay.

The conference was preceded by the ASSAL-FSI-IAIS high-level meeting on insurance supervision, which took place on 7 May. The supervisors-only event was jointly organised by the Association of Insurance Supervisors of Latin America (ASSAL), the Financial Stability Institute (FSI) of the Bank for International Settlements (BIS) and the International Association of Insurance Supervisors (IAIS) and hosted by the Central Bank of Uruguay (BCU). It provided high-level discussions on the following topics: insurance regulatory reforms and their implementations in the region, NatCat challenges and climate-related risks, and operational risks in a tech-driven insurance sector.

CoE Live Talk 08 | 7 May

The A2ii’s FeMa-Meter Toolkit was presented at the webinar “Confronting Challenges in Gender-Smart Climate and Disaster Risk Finance: Resources and Toolkits” hosted by FARM-D, PARM, and the Centre of Excellence on Gender-smart Solutions on 7 May 2024.

Blog

Unlocking Resilience: The Role of Climate-Related Data in Insurance Supervision - A2ii-IAIS Public Dialogue Report

This blog explores the growing recognition within the insurance industry and regulatory bodies regarding the importance of climate-related data for assessing and managing risks associated with climate change. The use of climate-related data is gaining significance as it assists insurance companies and regulatory authorities in understanding the potential impacts of climate change on insured assets, liabilities, and the industry's stability. It also highlights recent initiatives to promote climate data use and strengthen supervision related to climate risks by the International Association for Insurance Supervisors (IAIS). Additionally, it emphasizes technological advancements like artificial intelligence and machine learning, as well as the importance of global data and the need for collaboration among various stakeholders to improve catastrophe risk modelling and reduce the protection gap, featuring examples from both industry and insurance supervisors from California, Nepal and the Philippines.

Partner Opportunities

NAIC Fall 2024 In-Person International Fellows Program

The National Association of Insurance Commissioners (NAIC) invites you to apply for the NAIC Fall 2024 In-Person International Fellows Program, taking place September 30–November 12, or to consider nominating exceptional individuals in your agency for this unique training experience.

The International Fellows Program, offered virtually in the spring and in person during the fall, provides a rich training curriculum, offering insight into U.S. culture and our national state-based system of insurance regulation while strengthening relationships among U.S. and foreign regulators. Since 2004, over 1,000 regulators from 50 countries have participated in the program, and 41 U.S. jurisdictions have hosted the in-person sessions.

About the Fall 2024 In-Person International Fellows Program

Candidates must be well-qualified professionals, possess English proficiency, and agree to return to their home agencies to work for at least three years following their fellowship.

The NAIC and host state regulators will provide training materials. All other costs (airfare, lodging, meals, etc.) are the responsibility of the fellow's home agency and/or the fellow.

The program includes:

Training at the NAIC Central Office in Kansas City, Missouri, to learn how insurance regulation works in the U.S. and how the NAIC supports state-based regulation.

Working for five weeks at a state insurance department to see firsthand how states approach financial regulation, market conduct, licensing, and many other aspects of insurance regulation.

Spending two days at the NAIC's Capital Markets & Investment Analysis Office in New York City to learn how the NAIC keeps state regulators informed regarding investment risks and market trends.

NOTE: Before applying, applicants MUST receive their supervisor's approval.

Key Dates

• July 26: Fall 2024 NAIC International Fellows Program Application Deadline

• Sept. 28: Fellows arrive in Kansas City, Missouri

• Sept. 30–Oct. 4: NAIC Central Office, Kansas City, Missouri

• Oct. 5: Fellows travel to host states

• Oct. 7–Nov. 8: Host State Insurance Department Training

• Nov. 9: Fellows travel to New York City

• Nov. 11–12: NAIC Capital Markets & Investment Analysis Office, New York City, NY

• Nov. 13: Fellows return home

Candidates fully intending to participate in the Fall 2024 program can email Nikhail Nigam at nnigam@naic.org to obtain the application. All applications must be returned by Friday, July 26, 2024.

FeMa Meter Tool

Globally, women constitute the majority of the uninsured population and are underrepresented in insurance policymaking and supervision, which exacerbates their access challenges. A2ii has responded to these issues by launching FeMa-Meter on 8 March.

This toolkit collects and reviews sex-disaggregated data to analyse gender differences in insurance indicators. Piloted in Argentina, Lesotho, Pakistan, and Zambia, it has proven to be an effective tool for collecting sex-disaggregated data.

With an intuitive interface, users can input data and generate insights swiftly. To access the FeMa-Meter, visit its dedicated website and its accompanying training module. Join us in advancing gender equality and improving insurance access through data-driven approaches.

Index Insurance Insights

Learn about index insurance in our free training and obtain the A2ii-UNCDF Certificate on Index Insurance for Supervisors. Exclusively designed for insurance supervisors, this certification offers comprehensive insights into index insurance mechanisms. Ready to take the next step? Enrol now on A2ii’s learning platform, Connect.A2ii.

For all other stakeholders not in supervisory roles, access our open version of the training on our website.

Insurance Core Principles Self-Assessment Tool

Have you tried the SAT tool yet? The Insurance Core Principles Self-Assessment Tool is a joint initiative of the IAIS and the A2ii designed to facilitate the assessment of the level of observance of the ICPs. Leveraging the analytical framework of the Peer Review Process, it empowers supervisors to evaluate adherence to these essential principles.

How it works:

Supervisors can access the tool through the dedicated platform. Once on the platform, they can navigate through a series of questionnaires tailored to each ICP.

The questionnaires are crafted to cover various aspects of each principle, providing a comprehensive evaluation framework. Supervisors can respond to these questions based on their assessment of their jurisdiction’s practices and policies.

Upon completing a questionnaire, supervisors receive immediate feedback. These results offer insights into the level of observance of the assessed ICP, enabling supervisors to identify strengths, weaknesses, and areas for improvement.

We encourage all supervisors to explore this resource and its potential to drive positive change within the insurance landscape.

Trainings

Self-directed training

Supervision of climate-related risks in the insurance sector

Applying a gender lens to inclusive insurance

How to conduct a rapid gender diversity assessment

Index Insurance Training for All Stakeholders

Are you an insurance supervisor? Then join Connect.A2ii - our learning platform restricted to supervisors offering free and certified courses and an opportunity to learn from peers.

Useful Tools on Our Website

Inclusive Insurance Regulations Map

The interactive map incorporates data about existing inclusive insurance regulation and regulation which supports inclusive insurance sourced through A2ii's research, work and interaction with supervisory authorities worldwide.

ICP Self-assessment Tool

The tool is intended to help supervisors assess the level of observance of the Insurance Core Principles (ICPs).

Supervisory KPIs Lexicon

Interactive, searchable directory of KPIs for insurance supervisors across four pillars: prudential soundness, market conduct, insurance market development and the Sustainable Development Goals.

Insurance and the Sustainable Development Goals (SDGs)

The SDG pages include resources on the importance and the role of insurance across nine SDGs: 01 No Poverty, 10 Reduced Inequalities, 02 Zero Hunger, 03 Good Health and Well-being, 05 Gender Equality, 08 Decent Work and Economic Growth, 09 Industry Innovation and Infrastructure, 13 Climate Change and 17 Partnerships for the Goals.