A2ii Newsletter 08/20

Welcome! In this newsletter, we provide you with updates on the work of the Initiative, events and publications, and experiences and learning on inclusive insurance regulation and supervision across jurisdictions over the past month.

Follow us on Twitter @a2ii_org and LinkedIn and join the conversation on #inclusiveinsurance!

Subscribe to our mailing list to receive our newsletter in your inbox.

Navigation

Covid-19 | Recent Events | Upcoming Events | Blog | Knowledge Hub Highlight

The A2ii taking precautionary measures related to Covid-19 (coronavirus)

To safeguard the well-being of the A2ii staff and its partners, the A2ii is cancelling or postponing all physical events through the end of the year and exploring the use of virtual formats when possible. Events that are scheduled to take place from January 2021 onwards are currently under review. The A2ii will communicate any changes pertaining to our events on our website, social media channels and through our newsletter.

Covid-19 Insurance Supervisory Response Tracker

We have created a special page on our website dedicated to tracking worldwide supervisory responses, insurance news and learning resources (such as webinars).

Please feel free to share relevant news with us via secretariat@a2ii.org, by tagging Access to Insurance Initiative on LinkedIn or by mentioning us on Twitter. Visit the tracker.

A2ii-IAIS webinars

This year, due to the Covid-19 pandemic, the A2ii and the IAIS have held two exceptional webinar series: the series on the coronavirus (Covid-19) pandemic and implications for insurance supervisors (six webinars) and the pandemic risks webinar series (three webinars, two of which were open to all stakeholders). Some of the webinar presentations and recordings are available on our website under past events and on our YouTube channel.

Summaries of the webinars can be found on our blog.

iii-lab: Rwanda Team completes first national workshop series & global thematic peer exchange takes place | July

July was a busy month for the iii-lab teams!

Rwanda team completes its first national workshop series | 14 July

“We have achieved it online despite the challenges!”, commented one team member at the end of the sixth session. Everyone agreed that it was an interesting process with enjoyable and informative sessions. However, technological difficulties such as difficult internet connection meant that some sessions had to be postponed. Luckily, this did not prevent the team from engaging actively and being even more committed to the lab’s objective.

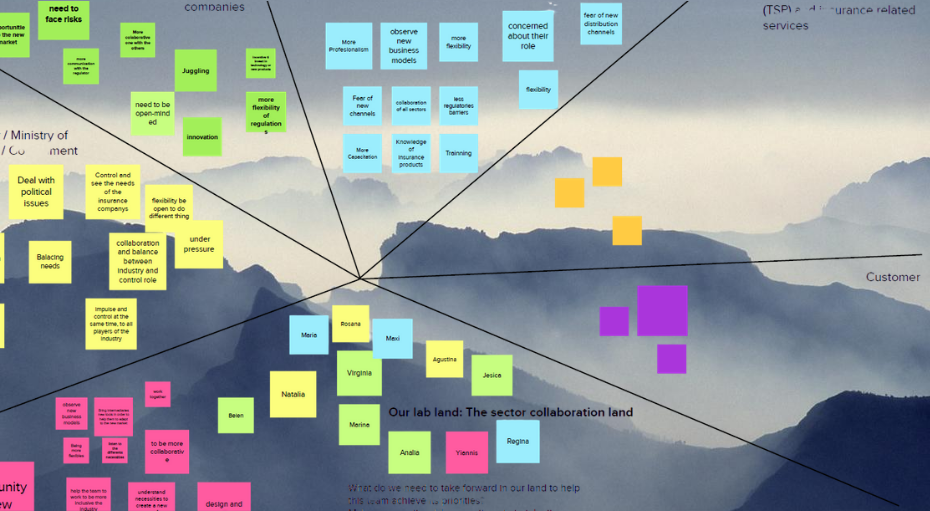

In the course of six online sessions the Rwanda team analysed its inclusive insurance sector and decided to focus its work on the following main beneficiary groups: farmers’ cooperatives & informal workers, e.g. individuals with temporary non-registered work or informal business owners. Next, based on methods explained in the lab, the team will conduct learning journeys where they will interview selected individuals from these groups to learn more about their lives and insurance needs.

Rwandan team members said:

“The lab pushed our thinking.”

“It was eye opening to hear views from all stakeholders.”

“We felt like were in person!”

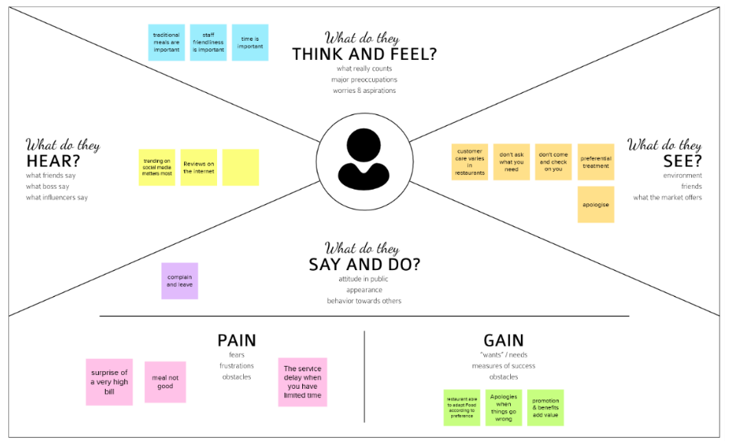

Figure 1: empathy map summarizing interview findings

All teams meet for global thematic peer exchange | 21 July

Second, all teams met for a global thematic peer exchange supported by the ILO’s Impact Insurance Facility, on 21 July.

Craig Churchill shared key success factors to effective business models in inclusive insurance and encouraged participants to share their own experiences on the topic. The session was a great success and a lively discussion showed that the teams are eager to find new and creative solutions to advance inclusive insurance in their countries.

Figure 2: Screenshot from the iii-lab global thematic peer exchange on 21 July

| The Inclusive Insurance Innovation Lab (iii-lab) is an international capacity-building programme where 4 countries' teams work on innovative solutions to advance the development of their insurance market. |

IFoA and FBD Roundtable on the Poverty Premium in the Insurance Sector | 16 July

The A2ii participated in a virtual roundtable held by the Institute and Faculty of Actuaries (IFoA) and Fair By Design (FBD) on the poverty premium in the insurance sector.

The poverty premium is the extra costs incurred by low income households when purchasing the same essential goods and services as higher income households. This can result in low income households being priced out and unable to purchase insurance. As a result, low income households are less likely to benefit from the protection against financial hardship that insurance offers.

The A2ii, along with other representatives from industry, consumer groups, and regulatory bodies, participated in a virtual roundtable discussion. The A2ii shared its perspective and knowledge on what fair outcomes for consumers means, as well as current supervisory developments on this topic.

During the course of the discussion, the participants discussed a fair insurance market and how it would look like for low income and vulnerable consumers. In addition, they deliberated on causes and solutions to the poverty premium in the insurance sector and identified areas for further research and action.

The discussion contributed to a forthcoming research and policy report being created by the IFoA and FBD.

A2ii-IAIS pandemic risk webinar series | 13, 23, and 30 July, WebEx

In the month of July the A2ii, in partnership with the IAIS, held a three-part special webinar series on pandemic risk. In an exceptional move, the first two in the series were public webinars open to all stakeholders whereas the third and final webinar was a closed-off session for supervisors only.

The first webinar held on 13th July focused on the protection gap. Through a moderated expert dialogue, participants gained insights from public sector organisations on initiatives underway to help Covid-19 recovery efforts as well as build resilience against future pandemics. Senior figures at the World Bank (Craig Thorburn), African Risk Capacity (Lesley Ndlovu), Asian Development Bank (Arup Chatterjee) and the United Nations Development Program (Jan Kellet) formed the expert panel.

The second webinar on 23rd July focused on public-private partnerships. During the webinar, we heard from the private sector about the impact of the current pandemic and their role in building greater resilience for the future through insurance solutions. Input was drawn from an expert panel consisting of Pool Re (Julian Enoizi), the Insurance Development Forum (Ekhosuehi Iyahen) and the Association of Bermuda Insurers and Reinsurers (John Huff).

The third and final webinar on 30th July was a supervisory dialogue that focused on the broader role of supervisors in bridging the pandemic risk protection gap. Speakers highlighted some of the existing risk-pooling schemes in place in their jurisdictions to protect against catastrophic risks and practices from these risk-pools, that can be emulated to address future pandemics. We heard from supervisors from FSCA-South Africa, NIC-Ghana, NAIC-USA and the former head of the Macedonian insurance authority.

Some of the recurring themes across the pandemic risk series were:

- Covid-19 has exposed existing vulnerabilities – the protection gap is not new but Covid-19 has brought it to the fore and highlighted the urgent need to address it.

- Systemic events like Covid-19 are too big for the private sector or public sector to bear alone and therefore there is a need for all stakeholders to work together to jointly develop solutions.

- Insurance needs to be better integrated into government & multilateral organisations’ disaster recovery planning

- Supervisors have a pivotal role to play in increasing consumer awareness and bringing stakeholders together to develop solutions to address the lack of insurance coverage for pandemic-related losses and risks

Keep an eye on our website where a summary of the key outcomes from the whole pandemic risk series will be published on our blog.

On our website, you can also watch the recordings of the public webinars from the 13 July on the protection gap and from 23 July on public-private partnerships.

The next webinar will take place on 17 September focusing on risk-based capital regimes in emerging markets. For more information and to register for the webinar, please click here.

A2ii presentation to the IAIS Covid-19 group | 21 July

The IAIS continues to hold discussions on the impact of the Covid-19 pandemic on the global insurance sector and the IAIS activities. As part of this, the A2ii presented to the IAIS’s Covid-19 group on the impact that the pandemic is having in emerging markets.

In particular, the A2ii focused on the varying regulatory responses and measures taken in response to the crisis. The A2ii highlighted the measures taken such as regulatory relief and temporary measures introduced to facilitate the distribution of insurance. The impact on the insurance sector was also briefly covered with the A2ii providing an overview of the challenges and potential opportunities that lie ahead.

Supervisors in the IAIS Covid-19 group were particularly interested in how the emerging markets were balancing the demands of financial stability and consumer protection as well as emerging risks such as cyber-attacks.

Risk-based capital regimes in emerging markets - A2ii-IAIS webinar | 17 September, WebEx

Over the last two decades supervisors have been refining their solvency standards and gradually moving to more risk-based regimes. Much research has been carried out on specific regimes, in particular the US Risk-Based Capital (RBC) system and the European Solvency II. However, transitioning to a risk-based capital regime is taking place at a different pace across the globe and so far, less attention has been given to understanding the spectrum of regimes elsewhere.

The webinar will include participation from supervisors who will share some of the challenges and lessons they have learned from implementing a risk-based capital regime in their jurisdictions. This Webinar is also in anticipation of an A2ii Landscape paper on variations in solvency requirements across Sub-Sahara Africa, Asia and the Caribbean.

This webinar will be open to supervisors only. It will take place at 10am CEST in English (with simultaneous French interpretation) and 4pm CEST in English (with simultaneous Spanish interpretation). The webinar will last one-hour and will take place via WebEx.

Click here for more information or to register.

If you have any suggestions or topics that you would like the A2ii to specifically cover for this webinar, then please don’t hesitate to get in touch via consultation.call@a2ii.org.

Blog

Switching between tabs: the virtual inclusive insurance innovation lab by Mariella Regh, A2ii

To overcome the social distance in online workshops is hard, even with the right preconditions, such as engaging content and participants who are mostly well-adjusted to using digital tools. As Covid-19 brought the world to a standstill, we chose to reformat our Inclusive Insurance Innovation Lab (iii-lab) - initially envisaged as an 18-months programme of six in-person workshops – into a fully virtual programme and to make it work. Continue reading...

Subscribe to our blog mailing list

Knowledge Hub Highlight

Proportionality in practice: disclosure of information

Proportionate regulations can encourage the industry to offer inclusive insurance in two main ways. The first is by lowering the barriers to entry. The second is by reducing the ongoing cost of doing business. In respect of disclosure, this can be done by allowing simplified, customised, or electronic disclosure of information, or tailoring requirements for agents to provide verbal product advice, for example. These measures enable insurers to reduce transaction and operational cost, as the traditional practice of printing and delivering extensive documents is costly.

The Proportionality in Practice case studies are intended to provide practical examples and generate lessons from the implementation experience of other supervisors who have implemented or begun the process of implementing proportionate regulations towards increasing access to insurance. This paper looks at proportionality in regulations relating to the disclosure of information to the customer by drawing on the experiences of Brazil, Pakistan, Peru and El Salvador.

Read Proportionality in practice: disclosure of information in English, Spanish or French.

Share this #KnowledgeHubHighlight on Twitter or LinkedIn.