A2ii Newsletter 05/21

Welcome! In this newsletter, we provide you with updates on the work of the A2ii, events and publications, and experiences and learning on inclusive insurance regulation and supervision across jurisdictions over the past month.

Follow us on Twitter @a2ii_org and LinkedIn and join the conversation on #inclusiveinsurance!

Subscribe to our mailing list to receive our newsletter in your inbox.

Navigation

Recent Events | Upcoming Events | Blog | Publications | Recommended Reading | Staffing Update | Useful tools on our website

The A2ii taking precautionary measures related to Covid-19

To safeguard the well-being of the A2ii staff and its partners, the A2ii is currently cancelling or postponing all physical events and adjusting them to virtual formats. As soon as it is possible, we will announce a return to physical events. The A2ii will continue to communicate any changes pertaining to our events on our website, social media channels and through our newsletter.

Recent events

A2ii-IAIS Public Dialogue on Insurance and the Sustainable Development Goals | 22 April

On Earth Day, the A2ii’s Head of Secretariat, Hannah Grant, and the IAIS’s Head of Implementation, Conor Donaldson, welcomed close to 200 participants from 50 different countries to the A2ii-IAIS Public Dialogue on Insurance and the Sustainable Development Goals (SDGs).

The event was opened by a pre-recorded message from Her Majesty Queen Máxima of the Netherlands, United Nations Secretary-General's Special Advocate for Inclusive Finance for Development (UNSGSA). In her keynote, Queen Máxima addressed the devastating impact the pandemic has had on the uninsured for current and future generations and the role that access to insurance must now play in responding to the crisis, concluding that in order to achieve the 2030 Agenda, it is critical to accelerate insurance as a risk protection mechanism.

This was followed by a key message from the IAIS delivered by Peter Braumüller, Chair of the A2ii and IAIS Implementation and Assessment Committee. He highlighted and demonstrated the IAIS’s longstanding commitment and work on sustainability, climate risk and financial inclusion, reiterating the need for collaboration and a multi-stakeholder approach in addressing these complex issues. He also highlighted the IAIS’s key partnerships including the A2ii, the Sustainable Insurance Forum (SIF) and the Network for Greening the Financial System (NGFS).

A panel discussion followed with leading experts: Susan Holliday, Senior Advisor at the International Finance Corporation (IFC), Garance Wattez-Richard, CEO at AXA Emerging Customers, Craig Churchill, Chief of the Social Finance Programme and Team Leader at ILO's Impact Insurance Facility and Christiaan Henning, Senior Insurance Analyst at the South African Reserve Bank (SARB).

The panel discussion started with an overview of the role insurance is playing in delivering the SDGs with examples shared by AXA EC and the ILO’s Impact Insurance Facility. The World Bank focused on the challenges they have encountered when trying to measure the impact that insurance has on the SDGs amongst the absence of indicators and data. Meanwhile, SARB touched on the challenges that supervisors face when aligning their supervisory mandate with the SDGs and how the goals generally relate to the financial system. However, all panelists agreed that the role insurance plays in supporting sustainable development needs to be better recognised by policymakers and others outside of the insurance sector. Although impact data is lacking, panellists proposed a number of specific actions to try and ensure the insurance sectors contribution is both better recognised and more fully utilised.

For more information please visit our website. The recording of the Public Dialogue is available on the A2ii website and our YouTube channel.

Upcoming events

Women's Access to Insurance – A2ii-IAIS Public Dialogue | 27 May

A gender gap persists when it comes to women’s access to financial services, including insurance. Women’s access to insurance and associated gender considerations are emerging priorities for stakeholders in the insurance sector and there is a clear and present need for integrating a gender perspective in insurance regulation and supervision.

The gender gap in women’s access to insurance is often attributed to challenges like lack of data, socio-cultural barriers and low levels of financial literacy, particularly for low-income women in developing and emerging economies. To bridge this gap, it is essential to design products that meet women’s specific needs and raise awareness of the transformative potential of gendered approaches in regulation and supervision. Promoting women’s access to insurance will also contribute to the achievement of broader policy objectives and the sustainable development goals, particularly SDG 5: Gender Equality.

On 27 May, the A2ii and IAIS will be discussing women’s access to insurance in our Public Dialogue. Insights from A2ii’s upcoming report on the theme will be presented. The participants will hear from industry experts as well as supervisory authorities who will share their experiences related to enhancing women’s access to insurance in emerging markets.

This webinar will be open to all stakeholders and will take place at 14:00 CET in English (with simultaneous Spanish and French interpretation). It will last one hour and will take place via WebEx.

Click here to register.

Applications are open for the Inclusive Insurance Training Programme

The A2ii, in partnership with the IAIS and the Toronto Centre will be delivering the Inclusive Insurance Training program in two regions this year - Central and Eastern Europe and Transcaucasia (CEET) from 21 June to 1 July and Sub-Saharan Africa (SSA) in September.

Registrations for the CEET program is now open, and registrations for the SSA programme will open later in May.

The training program is built on the IAIS Application Paper on “Regulation and Supervision Supporting Inclusive Insurance Markets” and allows participants to expand their existing supervisory skills and knowledge to develop the leadership skills needed to make positive change. This program will have a focus on how climate change and technology are impacting access to insurance and supervision.

This training will be delivered virtually and is aimed at middle-to-senior level supervisors involved in the regulation and supervision of inclusive insurance in Central and Eastern Europe and Transcaucasia. For supervisors wishing to participate from other regions, please register, and the A2ii Secretariat will contact you depending on available spaces.

For more information, please click here.

Applications are open for the 3rd Inclusive Insurance Innovation Lab

The Access to Insurance Initiative, in partnership with InsuResilience Global Partnership and Reos Partners, is calling for applications for the 3rd iii-lab - the climate lab.

What is it about?

The 3rd Inclusive Insurance Innovation Lab (iii-lab) 2021-2022 is an international capacity-building programme where 3-4 country teams composed of key stakeholders from the insurance sector will work on innovative insurance solutions to tackle one of the greatest global threats of our time – the impact of climate change, especially on the most vulnerable segments of the population.

The iii-lab will take place from September 2021 to September 2022. During this time, it is essential that all participants attend all the planned workshops and meetings, whether in-person or virtual: national and international meetings and virtual sessions (approximately 20 days in total).

The precise dates and locations of the workshops will depend on which countries are selected and on the respective Covid-19 situation.

For more information on the lab and the application process follow this link.

Blog

Insights from the A2ii-IAIS Supervisory Dialogue on IFRS 17: Implications for supervisors and the industry

by Carolyn Barsulai

After almost 20 years in the making, the release of International Financial Reporting Standard (IFRS) 17 Insurance Contracts has been heralded as one of the most significant recent developments in the insurance industry.

While many are anticipating implementation challenges, the new standard (starting for annual reporting periods beginning in 2023) is projected to have a positive impact on overall financial stability as well as to improve the transparency and global comparability of insurers’ financial reports. Continue reading…

Publications

A2ii publishes article in IFoA Inclusive insurance bulletin

In April 2021 the Institute and Faculty of Actuaries published Inclusive insurance bulletin 2: Responding to change.

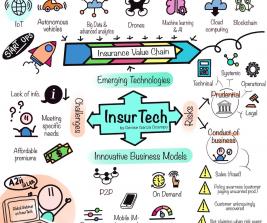

This bulletin considers the issue of fairness within the insurance sector and the role that technological innovation is playing in access to insurance.

The A2ii contributed an article entitled ‘The role for Insurance Supervisors in enhancing financial inclusion’. The article is an introduction to the A2ii’s work, mission, and key messages on inclusive insurance for insurance supervisors, including how they can be prepared for future supervisory developments.

Click here to read the A2ii article on page 6.

Recommended Reading

Joint IAIS-FSI note on ‘Redefining insurance supervision for the new normal’

The International Association of Insurance Supervisors (IAIS) and the Financial Stability Institute (FSI) have published a note on how insurance supervisors have transitioned to remote working and the effect on their supervisory processes and activities.

Using lessons learnt from the crisis, the note explores potential longer-term impacts of prolonged remote working and proposes some key considerations for insurance supervisors as they continue adjusting to the new normal of digitalisation well into the post-Covid future.

Click here to download the note.

Staffing Update

The A2ii is thrilled to welcome Erickson H. Balmes as our Regional Coordinator for Asia and Alwyn P. Villaruel as the Deputy Regional Coordinator.

Erickson H. Balmes has been designated as the A2ii Regional Coordinator for Asia. Erickson is the Deputy Commissioner at the Insurance Commission of the Philippines, where he was appointed in 2019. Previously, he was Undersecretary at the Department of Justice. In other roles, Erickson has also served as Consultant to the Commission on Elections, Consultant at the Senate of the Philippines, Chairman of the Board at Loyola Plans Incorporated, and Board Member at All Nations Security and Investigation Services. He is an attorney, lecturer in law and serves as a member of the Law Faculty of several universities.

Alwyn P. Villaruel has been designated as A2ii Deputy Regional Coordinator for Asia. Alwyn is presently the Division Manager of the Claims Adjudication Division and Budget Division and also the Media Relations Officer of the Insurance Commission (IC) of the Philippines. Prior to joining the Philippine insurance regulator, Alwyn was a litigation lawyer with experience in the areas of civil law and criminal law.

Useful tools on our website

Covid-19 Insurance Supervisory Response Tracker

Global tracker of supervisory responses, insurance news and learning resources. Share relevant news with us via secretariat@a2ii.org, by tagging Access to Insurance Initiative on LinkedIn or by mentioning us on Twitter.

Supervisory KPIs Lexicon

Interactive, searchable directory of KPIs for insurance supervisors across four pillars: prudential soundness, market conduct, insurance market development and the Sustainable Development Goals.

Inclusive Insurance Regulations map

The interactive map incorporates data about existing inclusive insurance regulation and regulation which supports inclusive insurance sourced through A2ii's research, work and interaction with supervisory authorities worldwide.

Insurance and the Sustainable Development Goals (SDGs)

The SDG pages include resources on the importance and the role of insurance across nine SDGs: 01 No Poverty, 10 Reduced Inequalities, 02 Zero Hunger, 03 Good Health and Well-being, 05 Gender Equality, 08 Decent Work and Economic Growth, 09 Industry Innovation and Infrastructure, 13 Climate Change and 17 Partnerships for the Goals.

ICP Self-assessment Tool

The tool is intended to help supervisors assess the level of observance of the Insurance Core Principles (ICPs).