Lessons so far: Beema Samiti-A2ii-UNCDF insurance supervisory capacity building support on inclusive and digital insurance

Lessons so far: Beema Samiti-A2ii-UNCDF insurance supervisory capacity building support on inclusive and digital insurance

What is it that makes digital, inclusive insurance possible – what kind of demand, supply or regulatory environment? What can the regulator reasonably do to provide such an environment, and how should a regulator go about planning and implementing this? And underlying all of that - what kind of support can capacity building providers such as A2ii provide to help insurance regulators along this journey?

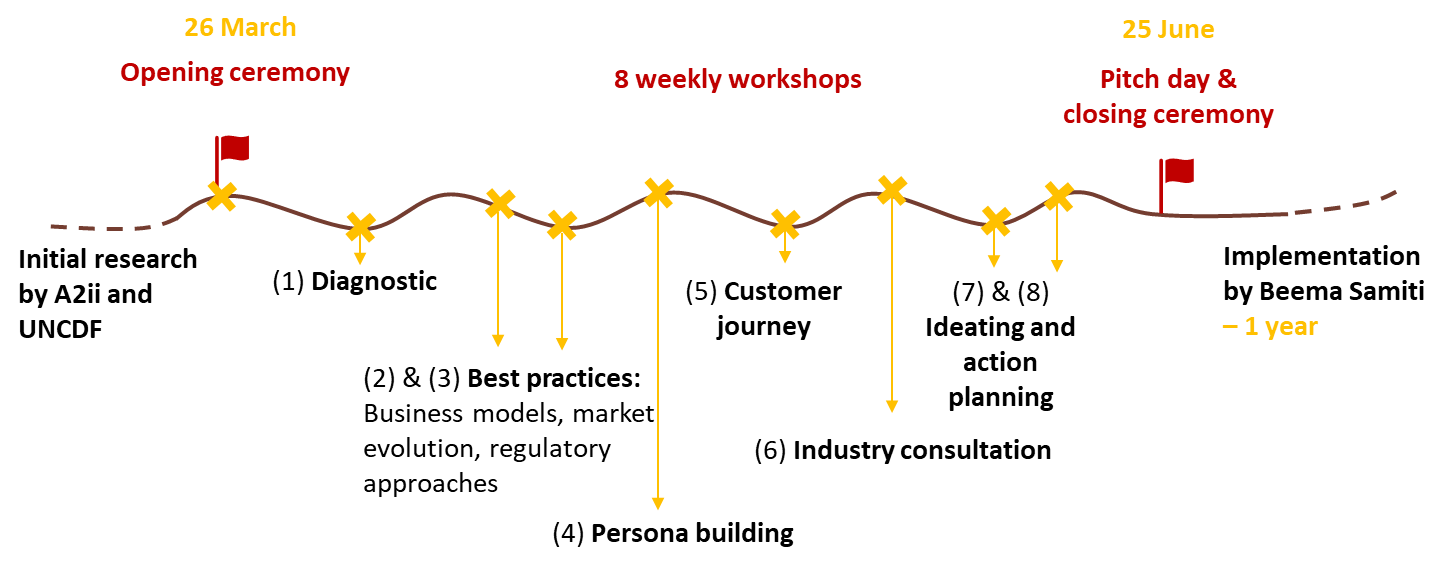

These were the questions on our minds when the Access to Insurance Initiative (A2ii) and United Nations Capital Development Fund (UNCDF) embarked on a capacity-building pilot with Beema Samiti, Nepal, on expanding access to inclusive and digital insurance in 2020. In this partnership, UNDCF leverages its global expertise on digital financial innovation as well as its on-the-ground presence, enabling coordination with local financial sector stakeholders in Nepal. Beema Samiti, Nepal’s insurance regulator, is well aware of the protection gap in Nepal and has long committed to efforts to address it. The Beema Samiti team comprised 9 participants from a cross-section of roles: senior analysts to middle management responsible for inclusive insurance in different ways such as policy development, supervision and product approvals.

The journey started with a ‘rapid diagnostic’: initial research on the country context, as well as demand, supply and regulatory factors in Nepal’s inclusive insurance market. It was done in a way that was enough to yield meaningful policy insights but not take up too much time or resources. The rapid diagnostic is essentially a ‘common-sense’ questionnaire based on the A2ii Toolkit 1: Country Diagnostic Studies. For instance: What do people do for a living? What does the population look like in terms of age, gender, income, geography? How accessible are digital tools in terms of access, usage, literacy? What does the insurance market look like?

Due to the pandemic, the research ended up much more desktop-based than expected. However, we learned something valuable: (1) Much data and information is available on the internet, which can be pieced together into a coherent assessment. Nepal’s Central Bureau of Statistics, for instance, publishes a wealth of information, such as the National Economic Census, Population Census, Labour Force Survey and the Multiple Indicator Cluster Survey, to name a few. The UNDP, Asian Development Bank and the World Bank also regularly publish economic insights on Nepal. A sweep of online newspapers gave us a gist of key consumer concerns; not the complete picture, but a starting point. Meanwhile, in the insurance space, Sakchyam and MEFIN have also undertaken various assessments with the support of Beema Samiti.

This opened our eyes to (2) how valuable it would be to pool data and information across public agencies and development organisations that have an interest in supporting vulnerable and low-income groups. For the regulator, being able to easily access data beyond standard regulatory reporting leads to sounder policymaking that is anchored on a much more multi-dimensional understanding of the low-income segments and their financial protection needs. For instance, it is challenging to discuss digital insurance without internet penetration, mobile phone ownership, and digital literacy. Data also brings to light and helps align common areas of concern among agencies, therefore highlighting opportunities to coordinate cross-sectoral initiatives. It could also be instrumental in steering, motivating and enabling the industry to target their inclusive insurance efforts well.

With the diagnostic in hand, we kicked off Phase 2: A series of 8 workshops, conducted weekly for two hours, every Friday. In the first workshop, our three organisations sat down together to comb through and check the diagnostic against Beema Samiti’s experience and knowledge. Beyond fact-checking, this session was also critical to build a joint understanding of the market, simply because without an agreement on where or what the baseline is, it would be challenging to agree on what to change. We discussed, for instance, who and how many the inclusive insurance target market group are. This step illustrated to us that (3) supervisory officers with the most relevant experience and day-to-day responsibilities need to be the ones in the room.

Armed with a shared understanding of the state of play, we looked outward to global experience in Workshops 2 and 3: How did inclusive insurance business evolve initially, and how is the approach evolving from traditional to digital business models? How have other regulators promoted inclusive innovation, and what regulatory requirements are critical? What has been the impact and tradeoffs? The team reflected on whether the solutions being tested out around the world would fit Nepal’s context. Here it was clear that (4) Changing regulatory processes are only one part of the picture. For example, consumers may not be ready to transition to digital processes. Yes, product development needs to be more inherently customer-centric, but industry competition dynamics might be making that difficult.

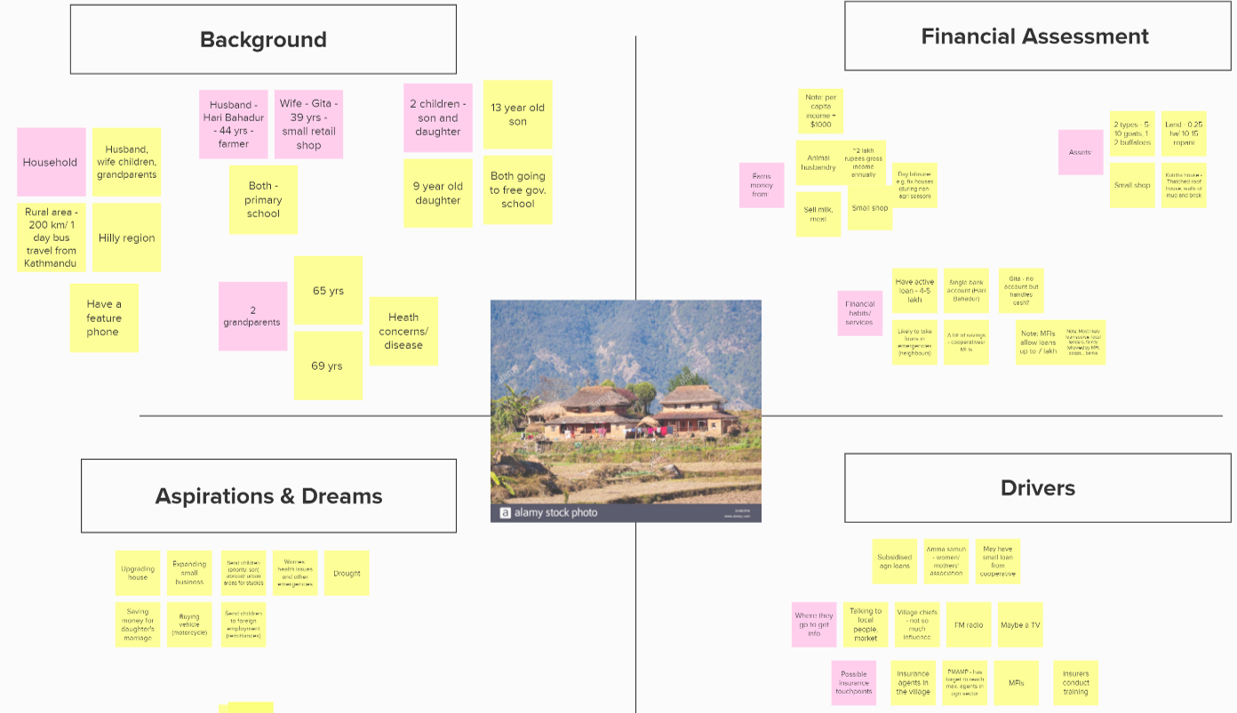

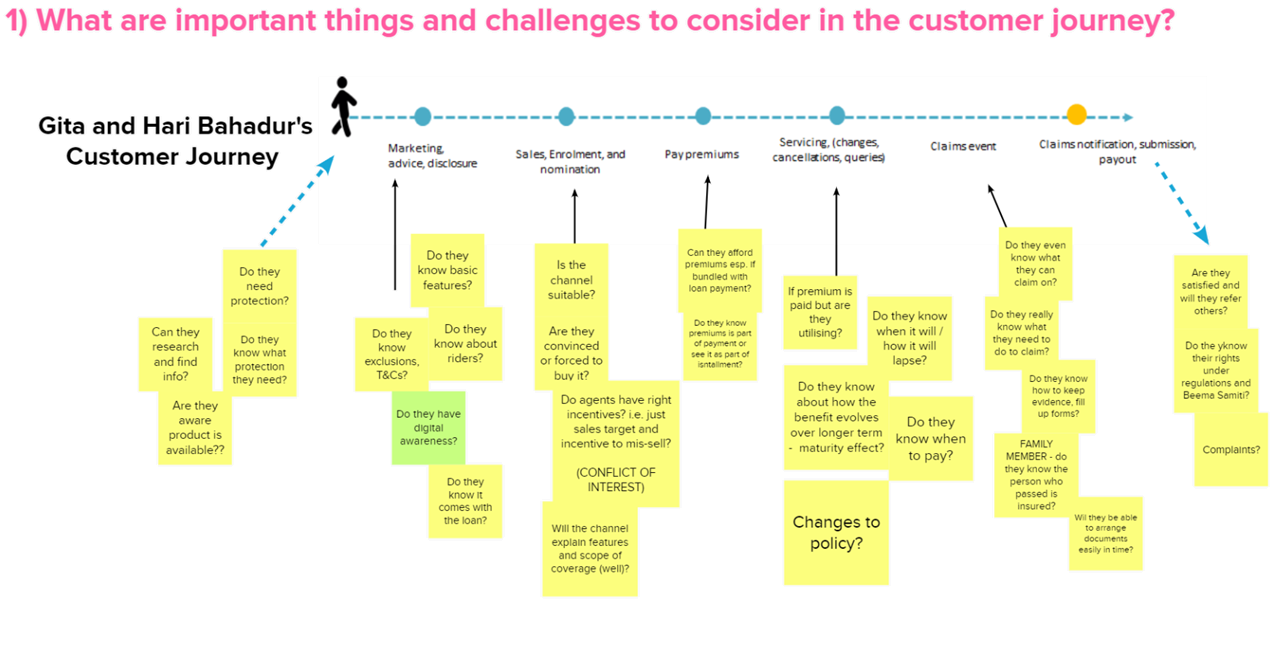

In Workshops 4 and 5, it was only natural to turn our focus to the heart of it all: The consumer. (5) Simply asking yourself (in a methodical and fact-based way) what it would be like to walk the insurance customer journey if you were an inclusive insurance customer – can be very powerful. We had established way back in the first meeting that all of us in the room personally knew someone who could benefit from inclusive insurance. Most of us have had personal experience with insurance. Between the rapid diagnostic and the Beema Samiti team’s knowledge, we also had some good demand-side statistics at hand. Now it was time to put this together into something more relatable.

The Beema Samiti team proceeded to sketch out the personas of Hari Bahadur and Gita – a couple in their early forties living in the mountainous region of Nepal, with two school-going children and two elderly parents to care for. The team sketched out their occupations, whether they have a phone or a television, and what drives their dreams, worries and everyday lives. This paved the way for a vibrant and reflective discussion: What would it be like for Hari Bahadur and Gita to buy insurance, from sales to claims? What would Beema Samiti, as a regulator, see as a concern, and how can they balance this against innovation?

Time and again, discussions kept veering back to customer-centricity. What does it mean in practice to ‘be more customer-centric’, both for the regulator and the industry? In Workshop 6, we spoke to a few insurance industry players: we learned about their business models, the competitive, regulatory and intermediary-side pressures they were facing, and key trends they were observing in the market. This session reinforced that (6) inclusive insurance is not an easy business. It is important to consider what can truly motivate insurers and make it easier for them to do it. It also reinforced how important it is for the regulator to (7) talk to the industry regularly and ask the right questions – practitioner perspectives can only enrich the regulator’s understanding of the market, leading to better-informed regulations and policymaking.

Workshops 7-8 were the final stretch. The team and facilitators had taken the full tour: starting from the birds-eye view of Nepal’s market, to global perspectives, to the customer journey, to the industry – now it was time to stand once again in the shoes of the regulator and circle back to the original question: What can Beema Samiti do to provide an enabling environment for inclusive and digital insurance in Nepal?

As all regulators and policymakers would know, (8) one of the toughest parts of action planning is narrowing down and prioritising to what can work and get it done. There is never a shortage of problems to solve or ideas to try – not in the inclusive insurance world where central banks and insurance regulators worldwide are increasingly focused on financial inclusion, especially in the face of climate change and the pandemic. But what are the measures that suit the local context? What would lead to the intended impact while being achievable in a reasonable amount of time, given all the human resources, financial resources, legal issues, stakeholder interests, and other constraints? What are measures that need to be done now – where does a regulator start?

In the final two workshops, Beema Samiti colleagues went through multiple rounds of ideating and discussions, adapting their action plan through a few iterations: The team identified the problems they wanted to solve, what growth they wanted to see and came up with a range of solutions. Through back-and-forth feedback, they separated out what can or needs to be done within a year versus in the longer term. All this was done in the lead-up to 25 June: Pitch Day.

On 25 June, the Beema Samiti team presented their 1-year action plan to a high-level panel: Mr Surya Prasad Silwal, Chairman of Beema Samiti; Mr Raju Raman Poudel, Executive Director of Beema Samiti; Mr Christopher Wolff, Inclusive Digital Economy Expert at UNCDF and Ms Hannah Grant, Head of Secretariat of the A2ii. The action plan sets out how Beema Samiti will engage with the insurance sector and inclusive insurance consumers moving forward. Over the next year, Beema Samiti will be implementing the action plan alongside monthly catch-up calls between the three organisations.

Mr Wolff encouraged the team to maximise this window of opportunity to fully realise the benefits of digitalisation. ‘This is a great time to do this, when people’s awareness of risk is higher than usual because of Covid-19.’ While the environment is difficult right now and a country will not be able to digitalise its insurance sector overnight, Mr Wolff notes that it is nevertheless a timely awareness-generating event, and digitalisation can help achieve outreach, cost efficiency and customer-centricity.

As Ms Grant noted: ‘[Today] is not a closing ceremony, but rather the finishing of the first phase and commencing of the implementation period. A2ii is happy to stay in contact and bring in global experience and peer exchange to support the journey.’ One important lesson for A2ii, in the context of working with regulators, is that (9) we need to listen to regulators and acknowledge the local dynamics, market development stage and barriers to implementation. Just like how copying and pasting insurance products for the inclusive sector does not work, copying and pasting regulatory solutions does not, either.

Mr Surya Prasad Silwal sums it up well: “I believe the one-year action plan developed by the team will help us drive the development of the microinsurance market in Nepal and contribute to the achievement of the ambitious target of increasing the insurance penetration to 33% of the population by the end of the coming fiscal year. It definitely requires hard work as well as intellectual, financial and human resources…Therefore let me wish all of us a lot of energy, enthusiasm and resolve on our way.”

We are not able to reveal more strategic details about the action plan at this stage but do stay tuned for updates as we continue down the journey.

The UN Capital Development Fund makes public and private finance work for the poor in the world’s 46 least developed countries (LDCs). UNCDF offers “last mile” finance models that unlock public and private resources, especially at the domestic level, to reduce poverty and support local economic development. UNCDF pursues innovative financing solutions through: (1) financial inclusion, which expands the opportunities for individuals, households, and small and medium-sized enterprises to participate in the local economy, while also providing differentiated products for women and men so they can climb out of poverty and manage their financial lives; (2) local development finance, which shows how fiscal decentralisation, innovative municipal finance, and structured project finance can drive public and private funding that underpins local economic expansion, women’s economic empowerment, climate adaptation, and sustainable development; and (3) a least developed countries investment platform that deploys a tailored set of financial instruments to a growing pipeline of impactful projects in the “missing middle.”

Beema Samiti is the Insurance Regulatory Authority of Nepal. It was constituted to systematise, regularise, develop, and regulate the country’s insurance business under the Insurance Act, 1992. BS looks after all the insurance-related activities in the Federal Democratic Republic of Nepal. As a regulatory body, BS’s primary concern is to create a professional, healthy, and developed insurance market in Nepal. It is formed as an autonomous body as per the Insurance Act of 1992.

The A2ii is a unique global partnership working to inspire and support insurance supervisors to promote inclusive and responsible insurance. As the implementation arm of the International Association of Insurance Supervisors (IAIS), A2ii identifies supervisory needs, develops tailored capacity building programmes, translates knowledge gained from the regions into global learning tools, contributes to the IAIS standard-setting activities, and supports the development and implementation of sound regulatory frameworks. The A2ii’s ultimate aim is to advance insurance markets globally and reduce low-income populations’ vulnerability to risk.

Share this article

Also in Blog

Authors

Posts by Author

Topics Cloud

Subscribe to our list

Receive notifications when we publish new blog entries

Subscribe here