Landscape of risk-based capital regimes in emerging markets

Landscape of risk-based capital regimes in emerging markets

Around the world, countries are transitioning their insurance markets to more risk-based capital (RBC) regimes to ensure that insurers have sound financial positions and hold adequate levels of capital. This, in turn, enables the insurance sector to withstand shocks, continue to operate and pay policyholders’ claims. The Global Financial Crisis taught us this lesson; the Covid-19 pandemic is a harsh reminder.

To date, much of the literature has focused on a few regimes at the forefront of this development, such as the US Risk-Based Capital system and the EU’s Solvency II. If we take a step back to scan the globe, however, we can see that the transition is happening at different paces in different places. Through our A2ii-IAIS-IAA actuarial skills training for insurance supervisors[1], we had the opportunity to take a close look at risk-based capital regimes in emerging markets, and their variations across Sub-Saharan Africa, the Caribbean and Asia. On 17 September, the learnings were shared on the A2ii-IAIS Supervisory Dialogue Risk-based capital regimes in emerging markets. Below, we bring you the takeaways.

Types of risk-based capital rules and the global landscape

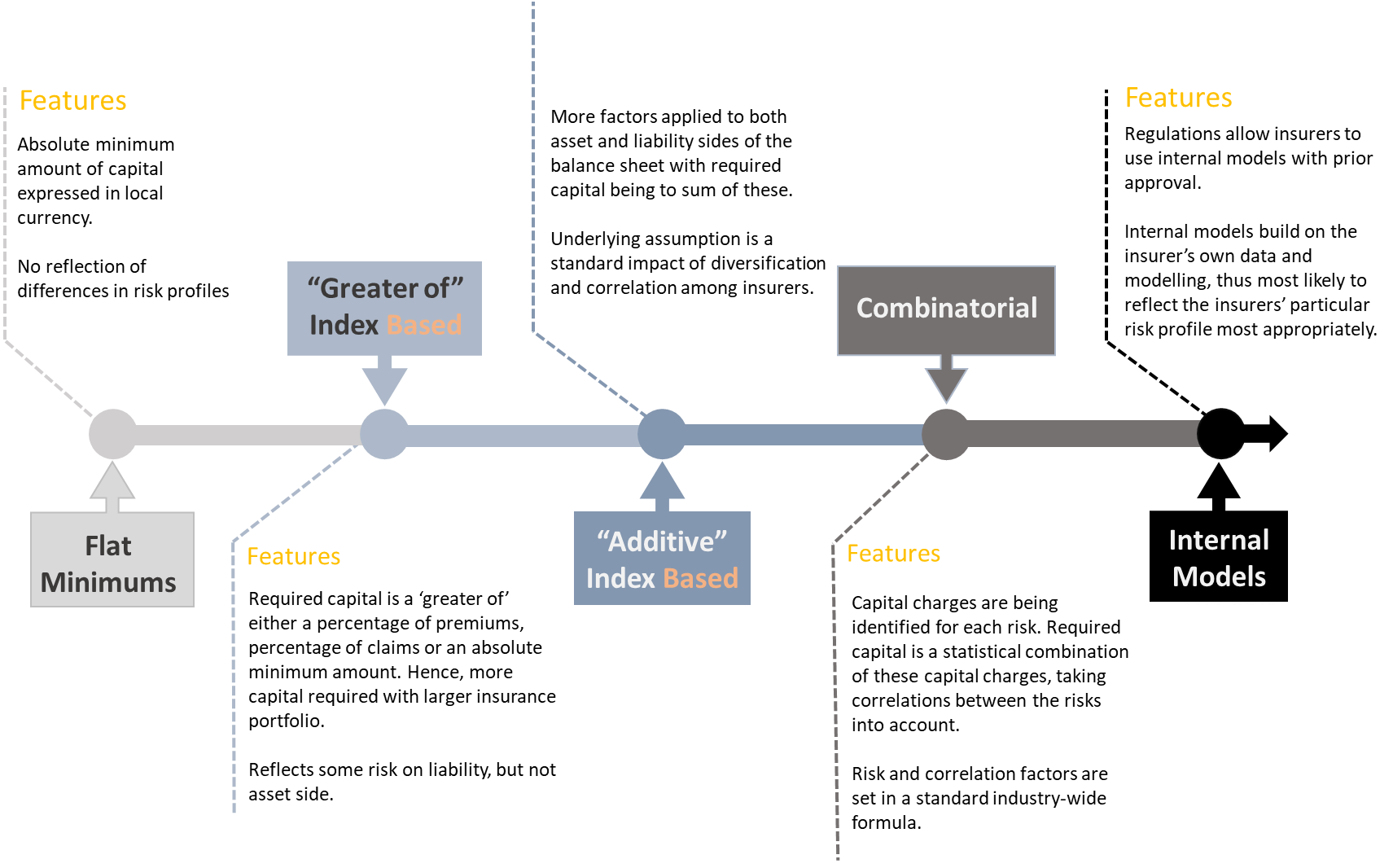

Craig Thorburn from the World Bank opened by showing how capital regimes today span a continuum from the least to most risk-sensitive. The span ranges from a requirement for insurers to hold the absolute minimum amount of capital in local currency (“Flat Minimums”), to sophisticated “Combinatorial” regimes that impute different kinds of risks, and correlations between them, on both the asset and liability side of the insurer’s balance sheet.

So, where do capital regimes in Sub-Saharan Africa, Asia and the Caribbean sit within this spectrum? Eamon Kelly, the lead trainer of the actuarial skills training, showed how only nine out of the 40 jurisdictions studied use Flat Minimums, the large majority of which are Caribbean. Even so, these Caribbean jurisdictions apply the Flat Minimums approach to long-term business only. General insurers already apply the ‘Greater of’ Index-Based approach to capital.

Indeed, the ‘Greater of’ Index-Based category is where most of the jurisdictions studied (55%) fall. This approach is comparable to the former European ‘Solvency I’: Instead of a fixed absolute amount, insurers’ capital is required to be the highest out of a number of predefined regulatory thresholds. These thresholds are usually a percentage of premiums and claims, resulting in insurers with larger portfolios holding higher levels of capital.

Moving further along the spectrum, approaches become more sophisticated – meaning, better accounting of the differentiations in risk on both the asset and liability sides. This involves setting ‘risk factors’ to calculate capital charges. About 20% of countries are in the ‘Additive Index-Based’ category, where capital is determined as a sum of these capital charges.

The ‘Combinatorial approach’ takes it up a notch by adding more refined risk and correlation factors to the equation, allowing for even more flexibility to reflect differences in companies’ business mix and risk profiles. Capital charges are statistically combined rather than merely a sum. Across the three regions, 15% of jurisdictions have implemented the Combinatorial approach. Examples for this category are also EU’s Solvency II or the US RBC system. However, they also allow for the additional option of the most sophisticated approach in the spectrum, ‘Internal models’, which some regulators selectively allow for larger companies in their jurisdictions. Only two countries in the sample, Rwanda and Mauritius, allow for this option in addition to the ‘Additive Index-Based’ rule.

Importance of risk-based approaches

Why move to risk-based at all, besides to align with international best practice and IAIS standards? Craig Thorburn put forth a couple of arguments in favour of capital reform:

- Recent research has shown that moving from compliance to a more risk-based capital approach supports insurance market development. By providing more flexibility, it encourages innovation and calls for investment in skills, enabling companies to search for new solutions rather than blaming rules for poor performance.

- Risk-based approaches are more efficient. Capital is allocated more appropriately to risk, reducing the amount of dormant capital.

- By giving the supervisor improved measures of financial soundness, comparability and proportionate ladders of intervention, RBC encourages better supervision.

In sum, RBC can benefit all parties – consumers, industry, supervisors. But as with anything in life worth working for, the road to RBC requires preparation and planning. An insurance supervisor who decides to embrace more risk-based systems needs to take into account the resource implications: more risk-based means more complexity, higher requirements for actuaries, skills and technical resources, both within the industry as well as the regulator.

Experiences from Sri Lanka and Kenya

Two countries that are quite advanced in their transition to a ‘Combinatorial’ and thus more sophisticated approach to capital are Kenya and Sri Lanka. On the Supervisory Dialogue, Chamarie Ekanayake (Insurance Regulatory Commission of Sri Lanka) and Elias Omondi (Insurance Authority of Kenya) shared their experiences and lessons learnt.

In Kenya, the process started in 2011 with the development of a 10-year-plan of change. The solvency regulations were published in 2017 with an intended 2-year transition period that has now been amended by another year to 2020. Meanwhile, Sri Lanka started the process with a Market Assessment Report in 2010, with a parallel run of the RBC framework with the former solvency regime beginning in 2014 and fully implemented its RBC in 2016.

Implementation of the new regime, from scoping to actual implementation, takes time – 6 and 9 years respectively for Sri Lanka and Kenya. While both countries are at different stages, some common lessons can be drawn from their respective journeys:

- Both supervisors emphasised the importance of collaboration and active stakeholder consultation and how consultations with the industry and other stakeholders such as the local actuarial association were built into the process from the beginning. Buy-in from senior management is important to implement the required (cultural) changes, such as the establishment of ERM systems or enhanced actuarial functions.

- As with everything else, there is no one size fits all approach. Supervisors can connect and consult with their peers on different models that already exist, discuss with experts and adapt existing approaches to their country context.

- Many technical challenges arise from transitioning, requiring actuarial expertise to be resolved.Sri Lanka shared the example of a one-off surplus created when migrating to the RBC regime. In Kenya, the IRA initiated a broad technical capacity building program right at the beginning on both, industry and regulator side.

- Data availability and accuracy is important and can be a challenge. Thus, developing proper data collection processes and a good understanding of the risk profiles of insurance companies along the way is crucial for successful implementation.

However, once implemented, RBC improves risk management of insurers, and adequate capital supports the sectors’ resilience and ability to absorb risk. Only a well-capitalised insurance sector will be able to withstand shocks, especially if they reach a magnitude as we are currently observing with the global pandemic.

For greater detail and information on what came up during the webinar, see the presentations available on our website here. The recording of the webinar is also available on request for insurance supervisors only. This blog is also in anticipation of an A2ii Landscape paper on variations in solvency requirements across Sub-Sahara Africa, Asia and the Caribbean that will explore these themes in detail. Do keep an eye out for the paper on the A2ii website.

[1] The A2ii in partnership with the IAIS and the IAA conducted three regional supervisory trainings on leveraging actuarial skills and techniques to enable a more risk-based approach to supervision in 2019. Based on information collected in the context of the training as well as discussions with insurance supervisors participating in this training, A2ii is working on a paper that aims at giving an overview of the capital adequacy regimes in these countries, as well as regional and cross-regional trends.