Download the report on the 10th Anniversary Conference: high level forum and expert symposium below.

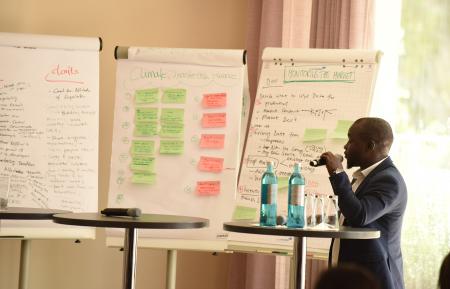

On 2–3 September 2019, over 70 insurance supervisors, development partners, practitioners and leading experts in inclusive insurance gathered in Frankfurt to participate in the 10-Year Anniversary Conference of the Access to Insurance Initiative (A2ii). Over a series of panels, discussions and breakout groups, the community reflected on the importance of inclusive insurance, the current state and impact of inclusive insurance regulation, as well as the opportunities and challenges that lie ahead. Seven key messages emerged overall. These messages offer food for thought for insurance supervisors, and will also guide the work of the A2ii moving forward.

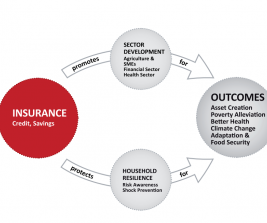

INCLUSIVE INSURANCE MATTERS: Inclusive insurance can contribute to national development objectives and the Sustainable Development Goals (SDGs). Yet, the role of insurance largely remains unrecognised and untapped by policymakers. Insurance supervisors can – and should – pursue inclusive insurance development and engage with policymakers, using the SDGs as a basis for discussion.

LEAD BY EXAMPLE: There is a clear role for supervisors in leading financial inclusion and market development efforts. Depending on the market context, supervisors can issue supportive regulation, bring together relevant stakeholders or put in place key infrastructure. An explicit market development mandate can be helpful in this regard.

DON'T REINVENT THE WHEEL, BUT DON'T COPY AND PASTE: Over the past decade, many supervisors have gained experience in inclusive insurance regulation, and this collective knowledge can be leveraged. However, it is important to take different stages of market development and the market context into account. Simply replicating other countries' regulations may not work.

LISTEN BEFORE REGULATING: Insurance supervisors need to have an open and constructive dialogue with the industry to keep pace with innovation. A few supervisors that have seen significant progress in their inclusive insurance markets engaged with the private sector from the beginning. However, it is important to strike a balance between regulatory certainty and flexibility.

SUMMARY COORDINATE WITH OTHER BODIES: Supervisors need to coordinate with other supervisory authorities and public bodies with different responsibilities and skillsets. This is particularly key in the face of changing insurance business models due to digitalisation and cross-cutting policy challenges like climate change.

MEASURE IMPACT BUT OPTIMISE: Understanding what has or has not worked in the past is essential to guide future regulatory measures. Documenting these lessons will also enable countries to learn from the experiences of one another. To measure impact, data is paramount. However, it is important to ensure that the data is meaningfully utilised, and that data collection does not disproportionately burden the industry.

BE PREPARED FOR FUTURE DEVELOPMENTS: Supervisory work will become more complicated due to technological developments. This is an opportunity for inclusion, but it also brings exclusion risks and consumer protection challenges. Regulations may also become obsolete as new business models emerge. Supervisors will need to adapt their regulations and processes, as well as build capacity.