Access to Insurance Initiative Newsletter 10/2018

Welcome to our monthly newsletter, where we update you on the work of the Initiative, inform you about events and publications, and share experiences and learning on inclusive insurance regulation and supervision across jurisdictions.

Follow us on Twitter @a2ii_org where we serve you news and updates on #inclusiveinsurance

Important update:

If you wish to continue to receive news about our events and publications, invites to our consultation calls and learnings about inclusive insurance regulation and supervision across jurisdictions, please take 5 seconds to confirm your subscription here. As of 1 November, we will only be sending our communications to the confirmed subscribers.

Confirm my subscription!

Recent Events

G20 Insurance Forum

24th- 26th September 2018, Bariloche, Argentina

Insurance supervisors, industry representatives, G20 members and international organisations met on 24th September in the city of San Carlos de Bariloche to discuss the crucial role of insurance and reinsurance in supporting sustainable growth. The event hosted by the Argentinean G20 presidency focused on themes of infrastructure investment, economic resilience and innovation.

During the first day, and the regulators only session, A2ii's Hannah Grant spoke on a panel exploring the role of the insurance sector in building resilient economies. While highlighting the need to build greater consumer awareness and confidence she also stressed the need for insurers to innovate and establish new partnerships to access and better serve consumers. The challenge for supervisors in striking the right balance between consumer protection and supporting market development also came to the forefront. The second day picked up on the same key themes as discussed during the regulators only meeting and sought input from the industry. The event was very well attended with around 250 participants taking part on the second day.

Regulatory and Supervisory Approaches to Inclusive Insurance, Impact Insurance Academy

10-14 September 2018, Turin, Italy

As part of their 10 year celebrations, the International Labour Organisation (ILO) for the first time organised a week-long training on inclusive insurance (‘Impact Insurance Academy’) at the ILO’s training centre in Turin. Representatives from insurance supervisors, associations, international organisations and the industry participated.

The A2ii facilitated an elective on the regulatory and supervisory approaches to inclusive insurance at the Impact Insurance academy earlier this month. The elective focused on the application of sound supervisory principles to encourage the development of an inclusive insurance market and supervisory approaches to responding to innovative solutions for inclusive insurance. The elective covered the objectives of inclusive insurance, understanding the market, considerations in developing an inclusive insurance framework, monitoring and reporting on inclusive insurance and current trends and challenges to the supervision of inclusive insurance. The programme was based on the

IAIS Application paper on the regulation and supervision of inclusive insurance markets, IAIS-A2ii Core Curriculum for Insurance Supervisors and A2ii Toolkits. It followed an interactive approach where participants were encouraged to share their experiences and give insights into proposed approaches in group discussions and activities.

Impact Insurance Academy was hosted by ILO's Impact Insurance Facility and the International Training Centre of the ILO.

Third national workshops of the Inclusive Insurance Innovation Lab

4-5 September: Nairobi, Kenya and Ulaanbaatar, Mongolia

11-12 September: Tirana, Albania

18-19 September: Accra, Ghana

The third and final national workshops of the Inclusive Insurance Innovation Lab took place in all four participating countries during the month of September. During the workshops, the country teams reviewed and adjusted their innovation ideas and identified further steps to implementation.

This last workshop also served the purpose of handing over the responsibility of the lab to the country teams. The teams developed clear visions for the future of their work beyond the official end of the lab process and external stakeholders were brought on board to support the implementation of the teams’ ideas. The participating country teams will continue to receive support through the A2ii, the Global Leadership Academy and the facilitation team from Reos Partners until December. The iii-lab process will come to an official end in December through an online reporting session, during which all participating country teams report on the progress they have made and identify ways in which they can offer peer support to each other in the future.

Alliance for Financial Inclusion (AFI) Global Policy Forum and launch of A2ii-AFI report on Inclusive Insurance in National Financial Inclusion Strategies (NFIS)

Sochi, 6 September

The A2ii moderated a high-level panel discussion on “Scaling insurance for financial inclusion” during the AFI Global Policy Forum. The panel discussion highlighted the role of public-private partnerships and financial education in increasing access to insurance. Moreover, it underscored the importance of including insurance in National Financial Inclusion Strategies and served as the launched event of a joint A2ii-AFI survey report on Inclusive Insurance in National Financial Inclusion Strategies.

The report summarises the status quo and lessons learnt on inclusive insurance in NFIS, based on a survey conducted by the A2ii and the Alliance for Financial Inclusion (AFI) and four country case studies.

The A2ii has also produced a short policy note on the issue Inclusive Insurance: a missing piece in many National Financial Inclusion Strategies, which summarises the main findings of the survey report and identifies lessons learned on how to include insurance in National Financial Inclusion Strategies.

Climate Risk Insurance and the InsuResilience Risk Talk Tool – IAIS-A2ii Consultation Call

20 September 2018 - webinar

This consultation call explored the role of insurance supervisors in climate risk insurance with presentations by the InsuResilience Global Partnership. Concrete examples at different levels (macro and micro) of climate risk insurance were given. Furthermore, an interactive community tool that can link insurance supervisors with climate change risk experts known as the “Risk Talk Tool” was introduced. The tool can enable supervisors to receive tailor-made answers on questions regarding climate change risk transfer.

More information on the tool can be found here.

Presentations of this Consultation Call are available on the A2ii website.

Upcoming Events

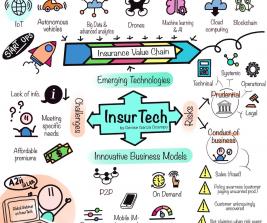

14th Consultative Forum on Digital Financial Inclusion and InsurTech

14th Consultative Forum on Digital Financial Inclusion and InsurTech

24 October 2018, Buenos Aires, Argentina

The International Association of Insurance Supervisors, the Microinsurance Network and the Access to Insurance Initiative will jointly organize the 14th Consultative Forum on “Digital Financial Inclusion” in Latin America. It is expected that approximately 70 high-ranking representatives from insurance supervisory authorities, the industry and the public sector will attend the event. The objective of the Consultative Forums is to bring about dialogue between policymakers, supervisors and the industry which is critical in fostering knowledge and sound policymaking in the field of inclusive insurance.

Find out more about this event or register at this link.

Watch the live stream here.

IAIS and SIF Issues Paper on Climate Change Risks to the Insurance Sector. – IAIS-A2ii Consultation Call

15 November - webinar

This Consultation Call will focus on the IAIS and SIF Issues paper on “Climate Change Risks to the Insurance Sector.” Experts on the call will give an overview of the impact of climate change on the insurance sector including current and future risks, and explore potential supervisory responses. Supervisors on the call will also get to hear concrete examples of observed practices in different jurisdictions. To register for the call, follow this link.

Inclusive Insurance Training Program for Supervisors in Central and Eastern Europe and Transcaucasia

12 - 16 November, Vilnius, Lithuania

The Inclusive Insurance Training Programme is jointly organised by the Bank of Lithuania, the Access to Insurance Initiative (A2ii), the International Association of Insurance Supervisors (IAIS) and the Toronto Centre. For more information on the event please follow the link.

If you are a supervisor from the CEET region interested in attending the training, please complete the online registration form.

Women’s World Banking and Alliance for Financial Inclusion (AFI) Leadership and Diversity Program for Regulators: a new program of inclusive policy design and leadership development for financial regulators

Begins January 2019

Applications deadline: 2 November 2018

The programme is intended for senior officials from central banks and other regulatory agencies in emerging markets, to equip them with technical and strategic know-how to create policy and leadership skills to affect change. The nine-month experience begins in January 2019 and includes ongoing virtual learning and a week-long intensive at Oxfor University’s Saïd Business School’s campus. Applications are being accepted on a rolling basis until 2 November 2018.

For more information about the program, visit the programme page or if you’re interested in being part of the inaugural class, apply now.

Recently Published

Inclusive Insurance in National Financial Inclusion Strategies Survey Report

Inclusive Insurance in National Financial Inclusion Strategies Survey Report

This report summarises the status quo and lessons learnt on inclusive insurance in National Financial Inclusion Strategies (NFIS), based on a survey as well as four country case studies.

For more than a decade, international guidance has been promoting the integration of insurance alongside other financial services. As such, inclusive insurance has increasingly gained importance with a growing number of policies and an increasing variety of products being offered. However, the topic of insurance has only recently become an integral part of NFIS or other financial sector strategies (FSS), therefore being considered in a comprehensive way in strategies at the national level. In order to take stock of this situation, to generate ideas for a way forward and encourage regulators and policymakers to effectively integrate insurance into their NFIS, a joint survey was conducted by the Access to Insurance Initiative and the Alliance for Financial Inclusion (AFI).

The survey was conducted amongst central banks, ministries of finance, insurance supervisors as well as other financial regulators involved in the development of NFIS. In addition, four country case studies were conducted to collect more detailed insights.

Inclusive Insurance – A missing piece in many National Financial Inclusion Strategies

Inclusive Insurance – A missing piece in many National Financial Inclusion Strategies

Policy makers and supervisors have been recognising the importance of National Financial Inclusion Strategies (NFIS) and Financial Sector Strategies as policy tools for financial inclusion. More recently, the topic of insurance has become an integral part of these strategies. Its integration is particularly relevant as insurance market development supports national policy objectives, promotes financial sector development, builds the resilience of vulnerable households, enterprises and communities, fosters the sustainable growth of households, enterprises and communities, and mobilises funds for investments. This note provides a summary of a stock-taking jointly implemented by the A2ii and the Alliance for Financial Inclusion (AFI), including the main results of a survey and examples from the case study countries Malaysia, Papua New Guinea, Paraguay and Tanzania.