A2ii Newsletter 01/20

Welcome to the first newsletter of 2020! In our opening message, we present an overview of what A2ii has in store for the upcoming year, and as always, we also provide you with updates on the work of the Initiative, events and publications, and experiences and learning on inclusive insurance regulation and supervision across jurisdictions.

Follow us on Twitter @a2ii_org and LinkedIn and join the conversation on #inclusiveinsurance!

Looking forward to 2020

As we enter the new year, we look forward to a year of progress in advancing inclusive insurance market growth!

Climate and disaster risk will remain high on our radar and a priority theme for 2020 as we continue to support supervisory needs with knowledge generation, capacity building and peer support on the topic. We also want to raise awareness with policymakers and strengthen our partnerships in this area.

On our regional agenda this year, we plan to roll out capacity building for insurance supervisors with actuarial trainings scheduled to take place in Central Europe and Transcaucasia, West Africa/Middle East and North Africa and Latin America. We will organise training on inclusive insurance supervision with a focus on climate in the Caribbean, and training in partnership with the Toronto Centre on inclusive insurance supervision for the Asia-Pacific region. And of course, we will have another series of bimonthly Consultation Calls this year for supervisors.

The second A2ii Inclusive Insurance Lab (2020 – 2021) will kick off in the beginning of the year with four selected countries: Argentina, India, Morocco and Rwanda. The country teams will participate in a series of national and international workshops designed to guide them in developing innovations suited for their markets, inspiring participants to take action and to equipping them with leadership skills in addition to new technical knowledge. Peer learning and exchange between the country teams will remain a key cornerstone of the project.

As well, we are happy this year to be sponsoring the participation of a senior official and a high-potential woman together in the Leadership and Diversity Program for Regulators developed by Women’s World Banking and faculty from Oxford University’s Saïd Business School. Also, as part of our capacity-building efforts for supervisors, we will sponsor a scholarship for the Microinsurance Master programme.

If you missed our historical timeline that launched at the end of last year, you will find it on our anniversary page. It showcases the history of A2ii, telling the story of our development, major milestones and the impact since its establishment through the voices of those involved at the time. We are proud of all that has been accomplished in the last ten years by our close work with supervisors, partnership with the IAIS and the support of our main donors, the German and the Dutch Federal Ministries for Economic and Foreign Affairs.

Best wishes to all for a happy and prosperous 2020!

Sincerely,

Hannah Grant

Recent events

A2ii Workshop ‘Stimulating responsible supply and demand to increase insurance penetration’ within the Training in Insurance Supervision and Regulation for the Insurance Development and Regulatory Authority (IDRA) of Bangladesh

25-29 November

25 participants of the IDRA of Bangladesh and the Bangladesh Insurance Sector Development Program (BISDP) of the World Bank participated in the interactive session which provided insights on how supervisors, policymakers and providers around the world have adopted innovative approaches to remove supply and demand obstacles to increase access to insurance. They also had the opportunity to understand better the needs and particularities of consumers in emerging markets. The underlying message of the workshop was that supervisors need to adopt proportionate approaches on regulation and supervision as innovation brings new risks and new participants in the market. Policymakers need to understand the role that insurance plays in society and to achieve public policies. The industry needs to design valuable, financially sustainable and scalable solutions that build the resilience of all. All stakeholders are invited to think out of the box and collaborate to unlock market development opportunities.

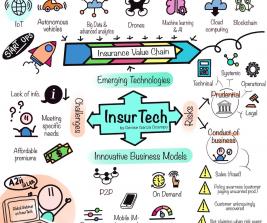

A2ii leads a session at AITRI-IAIS-FSI regional seminar on digitalisation

3-5 December, Singapore

The A2ii facilitated a session at the regional seminar for insurance supervisors in Asia and the Pacific, which was on “InsurTech: challenges of supervising insurance in a digital era”. The seminar was attended by 30 supervisors from 11 jurisdictions. The A2ii presented on inclusive insurance, InsurTech trends in this area, and the arising regulatory considerations. Participants then worked on case studies on digital platforms and mobile insurance, which took a customer journey approach to identify market conduct considerations for inclusive insurance consumers, and briefly discussed the trade-off between consumer protection and innovation.

The training was jointly organised by the ASEAN Insurance Training & Research Institute (AITRI), International Association of Insurance Supervisors (IAIS) and the Financial Stability Institute (FSI) of the Bank for International Settlements (BIS), and hosted by the Monetary Authority of Singapore (MAS).

4th Conference of the Arab Union of Insurance Regulatory Commissions (AUIRC)

4-5 December, Marrakech, Morocco

In cooperation with the Supervisory Authority of Insurance and Social Welfare (ACAPS), A2ii organised a half-day workshop on inclusive insurance for members of the Arab Union of Insurance Regulatory Commissions. After an introductory presentation by the A2ii, four supervisors (from Morocco, Tunisia, Egypt and Ghana) presented how inclusive insurance is regulated and supervised in their jurisdiction. The discussion indicated that there is an increasing interest in inclusive insurance, and especially digital insurance models, in the region and a number of experiences to learn from.

The A2ii also spoke on a plenary panel during the AUIRC conference on the topic of insurance education and policyholders' protection. Alongside supervisory representatives from Palestine, Morocco and the UAE, the A2ii shared some global insights. One of the main messages: consumer education campaigns work best when produced by public-private partnerships where the supervisor coordinates the different actors. For more information about the conference, see the programme here.

The third InsuResilience Global Partnership Forum on 'Strengthening Adaptation and Resilience in the Caribbean, Latin and Central America'

9 December, Madrid, Spain

The third InsuResilience Global Partnership Forum on Strengthening Adaptation and Resilience in the Caribbean, Latin and Central America took place alongside the CoP25.

The full-day event brought together members and partners of the InsuResilience Global Partnership to exchange experience and knowledge and raise awareness about risk finance and insurance. The A2ii contributed with a breakout session on An Enabling Regulatory Environment. In this session, participants discussed their differing mandates and interests in climate risk insurance as well as how supervisory authorities can ensure an enabling regulatory environment.

Outcomes from the session were presented on a panel discussion and included the following key messages:

• Through the adoption of proportionate regulatory and supervisory approaches, supervisors can stimulate supply and demand of climate risk insurance solutions and shape the contribution of the insurance industry towards building resilience. This includes making room to test innovations like index-based insurance schemes or the bundling of insurance products with seeds.

• Supervisors are also well-placed to act as a bridge and communication catalyst between the various stakeholders involved in climate risk insurance and to facilitate the sharing of experiences and best practices.

The annual meeting of the A2ii Governing Council

11 December, Basel, Switzerland

The A2ii Governing Council (GC) met in Basel this year, hosted by the International Association of Insurance Supervisors (IAIS).

The A2ii team shared highlights from 2019. This includes the progress of A2ii’s capacity building activities, which have been continually refined to focus more on supporting behavioral change going beyond just increased awareness and new skills.

Updates were shared on the year’s work on climate risk insurance, InsurTech as well as the launch of the ICP Self-Assessment Tool. The A2ii team also recapped the yearlong campaign in celebration of the A2ii’s ten-year anniversary.The GC discussed A2ii’s priorities for 2020 and approved the workplan and budget. It was agreed that climate risk will continue to be an important topic and a priority for A2ii in 2020.

The GC also deliberated on the role of A2ii in interacting with policymakers to create a supportive policy environment for inclusive insurance. Last but not least, the GC was happy to welcome Tomás Soley Pérez, Superintendent of SUGESE, Costa Rica to his first meeting as a newly-appointed GC member. The A2ii is also pleased to announce that the chairmanship of Peter Braumüller, Financial Markets Authority (FMA) Austria has been renewed for another 2 years. For the full list of A2ii Governing Council members, please click here.

Upcoming events

Climate risk insurance for the underserved and vulnerable: what is the role of insurance supervisors in fostering responsible development? A2ii – IAIS Consultation Call

30 January, WebEx

Climate change is increasing the severity and frequency of natural disasters, and the poor and vulnerable segments of the population are the most affected. Insurance, as a piece of the disaster risk management puzzle, plays a vital role in building resilience and protecting individuals and communities against disasters. The regulatory and supervisory environment contributes greatly in enabling innovative ways and mechanisms to reduce the climate insurance protection gap. Supervisors are well-placed to stimulate action that can strengthen resilience against climatic risks.

The next A2ii-IAIS consultation call will take place on 30 January 2020 and will be based on the A2ii’s thematic report: the role of insurance supervisors in climate risk insurance. This consultation call will provide highlights from the thematic report, and through looking at country case studies explore the role of insurance supervisors in building resilience and reducing the protection gap with respect to climate risks.

The call will be held again in three different languages - English, French and Spanish at the following times:

9am (CET) English || 11am (CET) French || 3pm (CET) English || 5pm (CET) Spanish

For more information on the Call and registration details, please follow this link.

If you have any questions that you would like to see addressed on the call, please send them to consultation.call@a2ii.org

Regional meeting for insurance supervisors from Sub Saharan Africa

3 February, Pretoria, South Africa

The A2ii together with the South African Reserve Bank and the IAIS will be organising a meeting for Sub-Saharan African insurance supervisors in Pretoria. The meeting is aimed at senior level representatives from supervisory authorities. The meeting will provide amongst others:

• an update on key activities and initiatives of the IAIS;

• an opportunity to gain information and engage on topical issues impacting the insurance sector like climate change and fintech (including suptech and regtech); and

• to share and engage on regulatory and supervisory developments in various jurisdictions

The second day of the meeting will focus on updating the strategic initiatives for the SSA region. This will be done in consideration of the new Strategic Planning Focus Objectives (SPFO) of the IAIS for 2020 to 2024. A2ii's Hannah Grant will be updating on A2ii activities as well as presenting on key messages from our climate risk report.

For more information on the event, please contact secretariat@a2ii.org.

Subscribe to our mailing list here to receive our news straight to your inbox!