Access to Insurance Initiative Newsletter 07/2018

Access to Insurance Initiative Newsletter 07/2018

Welcome to our monthly newsletter, where we update you on the work of the Initiative, inform you about events and publications, and share experiences and learning on inclusive insurance regulation and supervision across jurisdictions.

Follow us on Twitter @a2ii_org where we serve you news and updates on #inclusiveinsurance

Recent Events

Asian Forum of Insurance Regulators (AFIR)

7 and 8 June 2018, Hong Kong, China

On 7 and 8 June 2018, the 13th Annual Meeting and Conference of the Asian Forum of Insurance Regulators (AFIR) took place in Hong Kong. It was attended by about 50 regulators from 15 jurisdictions in the Asia-Pacific region. For A2ii, Janina Voss presented on inclusive insurance and introduced the work of the Initiative.

At the meeting, AFIR members elected Mr John Leung, Chief Executive Officer of the Insurance Authority (IA), as the new Chairman, replacing Mr Chen Wenhui, for a term of two years to 2020.

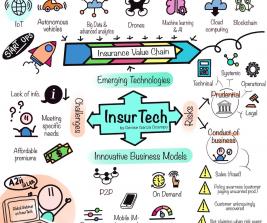

Under the theme “Building an Effective Regulatory Regime in a Changing Landscape”, participants exchanged experiences and perspectives on a number of “hot topics” for Asian supervisors in various panel sessions. With Asia being at the forefront of technological innovation, a great focus of discussions was on Insurtech developments and associated challenges, such as cybersecurity and data protection, but also the opportunities innovation provides

The AFIR meeting was preceded by the Financial Stability Institute's (FSI) Asia-Pacific high-level meeting on insurance supervision on 6 June, jointly organised by AFIR, the FSI, the Insurance Authority of Hong Kong and the IAIS. In the light of fast-growing insurance markets in Asia with, at the same time, penetration rates being still low in many parts of the region, topics discussed included the trade-off between prudential and conduct regulation as well as the great potential for more intensive regional cooperation of regulators in Asia to tackle common challenges and bring the emerging markets’ perspective into international discussions. For more information about this event follow the link.

2018 NAIC International Insurance Forum

14 and 15 May 2018, Washington DC, US

As the Chair of A2ii’s Governing Council, Peter Braumüller represented the A2ii at the 2018 NAIC International Insurance Forum. The Forum was attended by more than 340 participants, many of whom supervisors and industry representatives from the US. On a panel session dealing with the role of insurance in emerging markets, Peter Braumüller emphasized the role of regulation and supervision for improving access to insurance by the so far underserved. He highlighted a number of key challenges and risks in supervising inclusive insurance markets:

“Although these markets may focus on simpler or lower risk products, which might call for lower intensity in supervision, new approaches tend to create new risks in the market, e.g. consumers are less informed about insurance or are new to the insurance business altogether. There is also a great need for innovation in these markets that regulators might want to support. However, if sales in microinsurance go wrong, a large number of policyholders can be affected in their often first experience with insurance, thus damaging trust in the market in the long term.”

Supervisory dialogue on the impact of informality on insurance markets – what supervisors can do

17 May 2018, Rio de Janeiro, Brazil

The event provided an overview of how informality may affect insurance markets, examined the risks and focused on the challenges faced by insurance supervisors as a result.

The event also provided a platform for information sharing on the topic with presentations made on the approaches adopted by jurisdictions in different regions to of how best to encourage formalisation and greater financial inclusion.

The IAIS-A2ii Supervisory Dialogue was part of a three‐day series of events co-hosted by SUSEP, the Brazilian insurance supervisory authority and brought together more than 40 supervisors and regulators from 15 jurisdictions.

The report from the event is available here: Supervisory Dialogue Report

For information in Spanish and Portuguese and to view pictures from the event, visit the Supervisory Dialogue page.

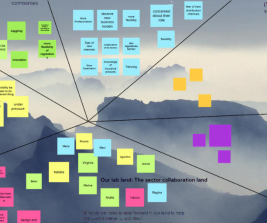

Inclusive Insurance Innovation Lab - Innovation Incubator meeting

19 – 22 June 2018, Durres, Albania

All four country teams participating in A2ii’s Inclusive Insurance Innovation Lab (Albania, Ghana, Kenya and Mongolia) came together at the final international meeting to advance the ideas and prototypes developed during the last national meetings. During learning journeys to local companies, the participants explored ways to put the customer at the centre of their activities. Feedback from external guests and peer support from lab participants from other countries provided useful insights and helped address some of the challenges in implementing the ideas. Participants also explored ways to continue their collaboration in the future and developed clear plans for implementation.

The Inclusive Insurance Innovation Lab is a capacity-building tool designed to help supervisors grow their markets and combat low insurance penetration rates. It consists of a sequence of national workshops and international platforms for supervisors and other key stakeholders. Find out more about the project at this link. You can follow the iii-lab on Twitter #iiilab and Youtube!

The 2018 Annual Conference of the Caribbean Association of Insurance Regulators (CAIR)

20 – 22 June 2018, St. Kitts & Nevis

The topic of the conference, which brought together 56 supervisors from 17 Caribbean countries, was “enhancing domestic and cross-border supervision and stress testing in the insurance sector”.

The topic of the conference, which brought together 56 supervisors from 17 Caribbean countries, was “enhancing domestic and cross-border supervision and stress testing in the insurance sector”.

Teresa Pelanda of the A2ii introduced the topic of inclusive insurance to the participants highlighting the important role supervisors play in enhancing access to insurance. Considering the increased intensity of hurricanes and other major natural catastrophes in the region, participants discussed natural catastrophes insurance from the perspective of inclusive insurance. Elizabeth Smith from FSC Jamaica shared their experiences on implementation of an index-based insurance product for low-income households.

Inclusive Insurance Training

18 – 22 June, Rabat, Morocco

From 18-22 of June, supervisors from French-speaking Africa came together in Rabat, Morocco for a training programme that went over the fundamentals of supervising inclusive insurance markets. The training was delivered in partnership with the Toronto Centre, the International Association of Insurance Supervisors, and the Moroccan supervisory authority (ACAPS).

Participants welcomed the training with great engagement, with over 15 African countries represented. The training helped participants understand better the importance of adopting a proportionate approach to regulation and supervision in order to improve access to insurance services and ensure adequate protection for low-income consumers. In addition, recent practices and case studies of selected jurisdictions that have advanced the field of microinsurance were presented. Participants exchanged experiences from their own countries and worked together onconcrete next steps in order to advance inclusive insurance markets in their own jurisdictions.

The A2ii, Toronto Centre and IAIS frequently partner to deliver these trainings, with the next one happening in November in Vilnius, Lithuania (more information can be found here).

Upcoming Events

IAIS-A2ii Consultation Call on Supervisory Responses to Fraud

IAIS-A2ii Consultation Call on Supervisory Responses to Fraud

19 July – webinar

On 19 July the A2ii and IAIS will be hosting their consultation call on “Supervisory Responses to Fraud”. The call will take place in 3 languages, and will be an opportunity to learn from other jurisdictions what kind of measures they have taken to monitor and address fraud. Please register for the supervisors-only consultation call here.

The consultation calls are 1-hour WebEx webinars. The presentations and call reports from previous consultation calls can be found on the A2ii website here.

First Impact Insurance Academy

10 - 14 September, Turin, Italy

The ILO's Impact Insurance Facility, the International Training Centre of the ILO and partners including the A2ii are excited to announce the launch of the first Impact Insurance Academy! This is a unique opportunity to learn from a decade of experience of the Facility in inclusive insurance!

The one-week Academy will take place at the International Training Centre of the ILO in Turin, Italy, from September 10 to 14, 2018 and combines plenary discussions with elective workshops, peer-assist sessions, real case studies and networking opportunities to offer you an inspiring and dynamic learning environment. The A2ii will be running afternoon breakout sessions on inclusive insurance regulation and supervision.

Visit the website to learn more about the Academy, the programme, and how to register! Deadline for registration is 20 July 2018!

Got any questions? Write to impactinsuranceacademy@itcilo.org.

Recently published

Event report: Supervisory Dialogue on the impact of informality on insurance markets – what supervisors can do

The event hosted by Superintendência de Seguros Privados (SUSEP) took place on 17 May 2018. The report provides an overview on how informality is affecting insurance markets, it examines the risks and challenges faced by insurance supervisors.

IAIS Issues Paper on Index Based Insurances, Particularly in Inclusive Insurance Markets

Index-based insurances are increasingly looked to as a means to manage weather and catastrophic event risks, support food security and enhance access to insurance. The IAIS Issues Paper which was published by the IAIS on 18 June, provides background on this product, describes practices and actual examples, identifies related regulatory and supervisory issues and challenges.

As IAIS’ implementation partner on financial inclusion, the A2ii participated in the IAIS drafting group of the Issues paper. The A2ii’s supervisor only WebEx call organised by the A2ii on the topic as part of its Consultation Call series was a key input to the drafting process.