A2ii Newsletter 12/19

Welcome to our last newsletter of 2019! In our opening message, we take a look back at the highlights of the last year, and as always, we also provide you with updates on the work of the Initiative, events and publications, and experiences and learning on inclusive insurance regulation and supervision across jurisdictions.

Follow us on Twitter @a2ii_org and LinkedIn and join the conversation on #inclusiveinsurance!

Looking back at 2019

On the brink of a new year after marking a decade of the A2ii’s work, it is with a sense of pride that I begin this letter. The anniversary celebrations provided a chance to look back and reflect on the many innovative projects the Access to Insurance Initiative has triggered by working closely with supervisors, the International Association of Insurance Supervisors (IAIS) and with the generous support of our main donors: the German and the Dutch Federal Ministries for Economic and Foreign Affairs. The A2ii has come a long way from its initial focus on knowledge generation, in 2019 alone, in partnership with the International Association of Insurance Supervisors, we organised 17 capacity building events attracting 809 participants from 106 countries.

Emerging Topics and Key Highlights

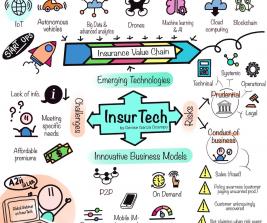

This has been a year where supervisors have increasingly had to grasp and respond to new challenges, owing, for the most part, to the surge of the digital economy. New business models, new digital players and new and more efficient ways of digital processing are emerging and the A2ii has sought to bring these closer to supervisors, for all their benefits and risks. The opportunities of InsurTech are also being explored in tackling climate and disaster risk, our 2019 priority theme, wherein improvements in satellite imagery and more efficient business models are leading to the development of more sustainable insurance solutions. To support and develop sustainable solutions, systemic action is only made possible by the art of collaboration between different stakeholders. The A2ii’s support to supervisors continues to be aligned with this principle.

At the three Consultative Forums which took place in South Africa, Panama and Bangladesh, we have facilitated dialogue and learning between policymakers, the industry and regulators on the topic of climate and disaster risk: building resilience and bridging the protection gap. Platforms such as these, which bring all stakeholders to the table, are vital for insurance to be able to fulfill its full potential and increase resilience. In addition to some of these ‘newer topics’, we have listened to supervisors to better understand what (‘old’) topics are of particular interest to them and together this continues to inspire our workplan.

Our knowledge generation and capacity building efforts this year were marked by a series of trainings in actuarial skills for insurance supervisors delivered in partnership with the IAIS and International Actuarial Association (IAA), the Inclusive Insurance Innovation Lab, and Consultation Calls on topics like Cloud Computing, Cyber Risk, Stimulating Demand, RegTech and SupTech, Regulating InsurTech and Closing the Gender Gap along with their respective reports. As well, supervisors can now make use of another new tool this year — after much effort, we launched a comprehensive self-assessment tool (SAT) for supervisors to test their compliance against individual Insurance Core Principles (ICPs) at their convenience.

Celebrating 10 years of A2ii

Without a doubt, the highlight of the year was celebrating the A2ii’s 10th anniversary in September! In Frankfurt, a two-day conference was held to celebrate the milestone and to reflect on what the regulatory community has achieved in the realm of inclusive insurance over the past years. If you missed it, recordings from the conference can be seen on the A2ii YouTube channel and shared content relating to the anniversary can still be seen on Twitter and LinkedIn via the hashtag #A2ii10. At the conference, the A2ii launched its decennium publication ‘A2ii: 10 Years On’, which explores the forces of change that have shaped inclusive insurance in the past ten years, as well as the next steps that we can all look forward to in the future.

We are proud to report that in our recently conducted 2019 stakeholder survey, 98% of the respondents believe the A2ii fulfils its mission, the highest number yet. As well, 94% of insurance supervisors agree that the A2ii events and technical materials help them to design regulations and supervisory systems that foster access to insurance. A big thank you to all who those who took the time to participate to give us such important feedback on our work through the survey!

Last, but not least, today we are delighted to launch a timeline showcasing the history of A2ii during the last 10 years. This tells the story of the A2ii’s development, showcases major milestones and the A2ii’s impact since its establishment through the voices of those involved at the time. We hope you will enjoy the look back at A2ii’s key events and the reflections from important figures in our history.

Best wishes to all during the upcoming holiday season and into the new year!

Sincerely,

Hannah Grant

Recent events

17th Consultative Forum on Climate and Disaster Risk for insurance supervisory authorities, insurance practitioners and policymakers “Climate and disaster risk: building resilience, bridging the protection gap in Asia”

4 November, Dhaka, Bangladesh

About 60 participants put their heads together in Dhaka to address these two key questions:

• What are the roles and responsibilities of each stakeholder to reduce the protection gap in climate risk insurance?

• What are the urgent steps that they have to adopt to make this happen?

During the event, both industry representatives, as well as public sector representatives, presented current approaches and challenges they face in implementing these solutions.

The insurance sector plays a crucial role in protecting and mitigating the impact of climate change. However, insurance is only one building block of a comprehensive disaster risk management framework.

Considering this, the World Food Program’s R4 program, an integrated microinsurance approach, includes not only insurance for assets but also risk reduction and risk transfer mechanisms. CARD Pioneer offers different products to help protect individuals against climate risk in the Philippines. This does not only contribute to longer-term resilience building at the individual household level, but also strengthens independence from international aid. Besides the private sector, the public sector can contribute to more resilient societies ensuring political support and recognising the important role governments can play. This does not only include the provision of subsidies. In Bangladesh for example, part of a recent paradigm shift from relief to preparedness is the current revision of disaster risk management policy documents to ensure they explicitly include insurance. Some risks individuals face in the context of climate change may also call for governments to consider more mandatory insurance products to be included in regulatory frameworks.

It took place alongside the 15th International Conference on Inclusive Insurance in Dhaka, Bangladesh.

You can read key insights here.

Plenary on the topic of “The role of policy, regulation and supervision in enabling climate risk solutions” at the 15th International Conference on Inclusive Insurance

6 November, Dhaka, Bangladesh

The panel discussion, moderated by Andrea Camargo, A2ii, highlighted the important role supervisors can play in enabling climate risk insurance solutions. Supervisors can not only adopt proportionate regulatory and supervisory approaches that to stimulate supply and demand of climate risk solutions. They are also well-placed to engage in national strategies on disaster risk management and ensure the incorporation of responsible insurance solutions, as emphasised by Teresa Pelanda, A2ii, in the introductory presentation.

Kristian Mangold, Public Sector Business Developer at AXA Climate, presented a global landscape of AXA’s parametric insurance solution on the micro and macro level and with a strong focus on PPPs. He outlined some of the regulatory challenges AXA is confronted with when developing climate risk insurance products. Besides restrictions in the use of alternative distribution channels, one major constraint is slow product approval processes.

The Insurance Regulatory and Development Authority of India (IRDAI) takes a couple of active steps to address these challenges and barriers and to further boost inclusive insurance and climate risk insurance in particular. From a public perspective, this is particularly important with 70% of the population depending on agriculture and being highly impacted by natural catastrophes. Yegnapriya Bharath, Chief General Manager of IRDAI, said, “We have to be fast in approvals, but we have to ensure that the product benefits the policyholder.” In order to speed up the product approval process, IRDAI engages in the development of standard products. To increase take up of climate risk insurance products, IRDAI also conducts initiatives on insurance awareness in schools and universities and made insurance mandatory for agricultural loan takers.

A2ii participates in panel at the 26th IAIS Annual Conference

14-15 November, Abu Dhabi, UAE

Digital innovation in insurance brings about many opportunities but also risks. This was the key premise of the 26th IAIS Annual Conference on ‘SUPERVISION IN A DIGITAL ERA’, which was discussed at length via five panels covering cyber resilience, data, financial inclusion, cloud and outsourcing, and shifting market structures. Supervisors, industry representatives and other stakeholders discussed recent innovations and the resulting risks that ‘keep supervisors up at night’ and deliberated on how the supervisory community should define their role and approach in response to these developments.

The A2ii participated in a panel on “Digital Financial Inclusion – Innovation Beyond Imagination”. Moderated by the Financial Stability Institute, the panel also included the Hong Kong Insurance Authority (IA), the National Insurance Commission (NIC) of Ghana, Etherisc and Neurotrack. A2ii gave an introduction to inclusive insurance consumers and regulations, and InsurTech developments in inclusive insurance. The IA and NIC shared their experience with digital insurers and mobile insurance, alongside Etherisc and Neurotrack who shared their work on blockchain, index insurance and health tech. All parties agreed on the importance of constructive dialogue between the industry and supervisor - the A2ii also shared instances of where such dialogue have helped support innovation, drawing on insights gained from the experience with the inclusive insurance innovation lab (iii-lab).

Inclusive Insurance Training Programme for Latin American Supervisors

18 – 22 November, San José, Costa Rica

The training program was designed to help participants understand the importance of a proportional approach to regulation and supervision to improve access to insurance services. The program also included sessions on current practices of selected jurisdictions that have advanced in the field of inclusive insurance. During the training, 24 insurance supervisors - from Bolivia, Costa Rica, El Salvador, Guatemala, Paraguay, Peru and Puerto Rico, worked on action plans, exchanging experiences and information with their peers and experts. This was the first time that A2ii joint training with the Toronto Centre was fully organised in Spanish with no translation!

A2ii - IAIS Consultation Call on Cloud Computing: Regulatory and Supervisory Approaches

28 November

This consultation call drew upon the Financial Stability Institute (FSI) Insights paper on Regulating and supervising the clouds: emerging prudential approaches for insurance companies. Experts on the call explored how advancements in digital technologies are transforming various areas of the insurance value chain and how cloud computing acts as an enabler of innovation in the insurance sector. Cloud computing achieved this by offering insurance companies and their third-party service providers the possibility of using computing resources, capable of processing large amounts of data in real time under a network that interconnects various sources of information. This call also highlighted the characteristics of cloud, its different deployment models and service models as well as the global distribution of the main cloud service providers. It also highlighted the potential benefits and risks of using cloud computing services. Drawing on the FSI Insights paper, supervisors on the call also got to hear emerging regulatory approaches implemented by various authorities and the supervisory practices that may be required for cloud computing. Presenters on the calls were Denise Garcia Ocampo, Senior Advisor, Financial Stability Institute (FSI), Andrea Camargo, the technical expert of the A2ii and director of Inspowering, Lázaro Cuesta Barberá, Senior Expert, European and Occupational Pensions Authority (EIOPA), Paulo Miller, Head of the Office of studies and Institutional relations and Gustavo Adolfo Araujo Caldas, Technical Analyst, Office of Studies and Institutional Relations, Superintendência de Seguros Privados (SUSEP) and Sanjeev Chandran, Technical Specialist, Bank of England.

For supervisors who could not attend this call, the presentations are available here and the report will be available on the A2ii website.

Supervisors can also direct questions on this topic to consultation.call@a2ii.org, and we will ensure your questions are addressed.

A2ii leads session at AITRI-IAIS-FSI regional seminar on digitalisation

3-5 December, Singapore

The A2ii facilitated a session at the regional seminar for insurance supervisors in Asia and the Pacific, which was on “InsurTech: challenges of supervising insurance in a digital era”. The seminar was attended by 30 supervisors from 11 jurisdictions. The A2ii presented on inclusive insurance, highlighting trends in InsurTech and the arising regulatory considerations. Participants then worked on case studies on digital platforms and mobile insurance, which took a customer journey approach to identifying market conduct considerations for inclusive insurance consumers, and briefly discussed the tradeoff between consumer protection and innovation. The training was jointly organised by the ASEAN Insurance Training & Research Institute (AITRI), IAIS and the FSI of the Bank for International Settlements (BIS), and hosted by the Monetary Authority of Singapore (MAS).

4th Conference of the Arab Union of Insurance Regulatory Commissions (AUIRC)

4-5 December, Marrakech, Morocco

In cooperation with the Supervisory Authority of Insurance and Social Welfare (ACAPS) A2ii organized a half-day workshop on inclusive insurance for members of the Arab Union of Insurance Regulatory Commissions. After an introductory presentation by A2ii’s Hannah Grant and Mariella Regh, four supervisors (from Morocco, Tunisia, Egypt and Ghana) gave a presentation explaining how inclusive insurance is regulated and supervised in their jurisdiction. A lively discussion showed that there is an increasing interest in inclusive insurance, and especially digital insurance models, in the region and a number of experiences to learn from.

A2ii was also invited to speak on a plenary panel during the AUIRC conference on the topic of insurance education and policyholders' protection. Alongside supervisory representatives from Palestine, Morocco and the UAE, Hannah Grant shared some global insights. One of the main messages: consumer education campaigns work best when produced by public-private partnerships where the supervisor coordinates the different actors. For more information about the conference, see the programme here.

Upcoming events

Sub-Saharan Africa Supervisory Regional Meeting

3-4 February 2020, Pretoria, South Africa

The A2ii together with the South African Reserve Bank and the IAIS will be organising a meeting for Sub-Saharan African insurance supervisors in Pretoria. The meeting is aimed at senior level representatives from supervisory authorities. The meeting will provide supervisors with a chance to discuss trends, challenges and opportunities in regulation and supervision with their peers including those arising from climate risk and digital developments. For more information on the event, please contact secretariat@a2ii.org.

A2ii – IAIS Consultation Call on Climate risk insurance for the underserved and vulnerable: What is the role of insurance supervisors to foster its responsible development?

30 January 2020 - WebEx Webinar

The next A2ii-IAIS consultation call will be based on the A2ii’s thematic report: the role of insurance supervisors in climate risk insurance. This consultation call will provide highlights from the thematic report, and through looking at country, case studies explore the role of insurance supervisors in building resilience and reducing the protection gap with respect to climate risks.

Climate change is increasing the severity and frequency of natural disasters, and the poor and vulnerable segments of the population are the most affected. Insurance, as a piece of the disaster risk management puzzle, plays a vital role in building resilience and protecting individuals and communities against disasters. The regulatory and supervisory environment contributes greatly in enabling innovative ways and mechanisms to reduce the climate insurance protection gap. Supervisors are well-placed to stimulate action that can strengthen resilience against climatic risks.

For more information on the Call and registration details, please follow this link.